Is It Altcoin Season Yet? Exploring the Rise of Alternative Cryptocurrencies

Overview or Introduction

The cryptocurrency market is at a fascinating juncture as we approach the end of 2024. With Bitcoin recently hitting unprecedented heights amid favorable political winds, attention is now shifting to the so-called altcoins—the alternative digital currencies that could soon rally significantly. This article delves into the factors shaping the cryptocurrency landscape, analyses why we might be entering a vibrant altcoin season, and showcases which coins are gaining traction among savvy investors.

With Bitcoin’s recent climb to $100,000 following the U.S. presidential election, market dynamics are shifting. Investors are curious: will altcoins outperform Bitcoin in the coming months? Discover the nuances of this evolving asset class, the potential for gains, and the indicators signifying an exciting altcoin season.

The Altcoin Evolution

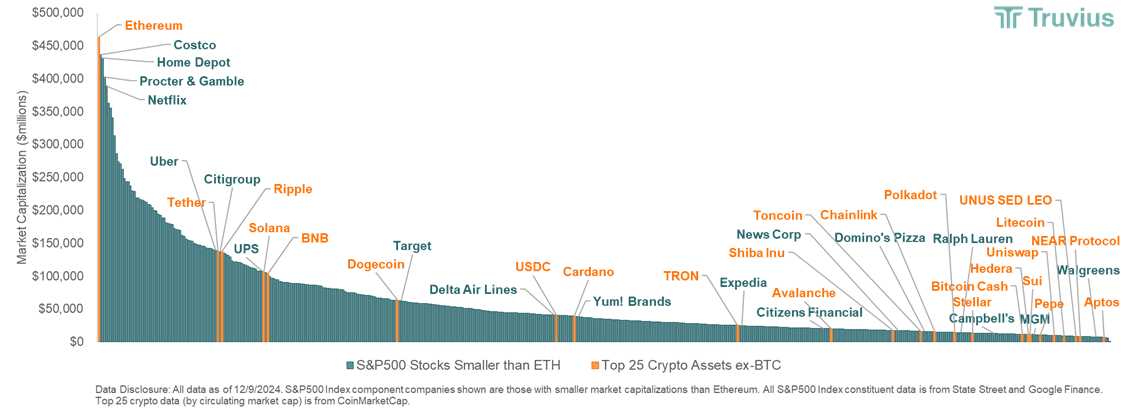

The term “altcoin” has historically referred to all cryptocurrencies other than Bitcoin. But as the landscape of digital assets expands, this binary view is becoming obsolete. In the wake of growing regulatory clarity and innovative developments within the sector, altcoins are evolving into a diverse array of investment options. Market commentators are beginning to categorize cryptocurrencies as a multi-sector asset class rather than grouping everything beyond Bitcoin as mere alternatives.

In recent weeks, notable increases in trading volume for coins like Toncoin, Litecoin, and Tron have captured attention, indicating a potential shift in investor behavior away from Bitcoin towards these lesser-known assets. As investor sentiment gravitates towards altcoins, we may be at the forefront of a significant altcoin rally.

Indicators of Altcoin Season

The “Altcoin Season Index,” which measures the performance of the top 100 cryptocurrencies (excluding stablecoins) against Bitcoin, is a crucial indicator for detecting altcoin seasons. Currently, this index shows a value above 80, suggesting that a majority of altcoins are outperforming Bitcoin, which typically signals the arrival of an altcoin season. Notably, many of these smaller cryptocurrencies have demonstrated remarkable price surges in recent weeks, far surpassing Bitcoin’s performance.

For instance, Hedera (up 481%), Stellar (up 415%), and Sui (up 383%) illustrate the significant shift in investor focus toward these assets, making it an exciting period for traders. As more investors rotate into altcoins, the potential for substantial returns increases.

Strategizing for Altcoin Investment

While the allure of altcoins is undeniable, investors must approach with caution. Successful altcoin investing is predicated on choosing not only well-established cryptocurrencies but also considering innovative projects with robust fundamentals. Coins such as Toncoin, which is showing bullish signals amidst increasing transaction volumes, have become attractive options for those looking to optimize their portfolios for the altcoin season.

Litecoin and Tron are also garnering attention, with bullish indicators suggesting potential price increases as the altcoin market starts to heat up. Investors are advised to conduct thorough research and focus on cryptocurrencies with strong use cases and community support to safeguard against the volatility common in this space.

Key Takeaways

- Bitcoin’s recent rise has catalyzed new interest in altcoins, potentially signaling the start of an altcoin season.

- The Altcoin Season Index is a critical metric, currently indicating strong outperformance of numerous altcoins against Bitcoin.

- Toncoin, Litecoin, and Tron are among the altcoins showing considerable growth potential, driven by rising transaction volumes and market interest.

- Investors should prioritize established altcoins with strong fundamentals while remaining cautious of market volatility.