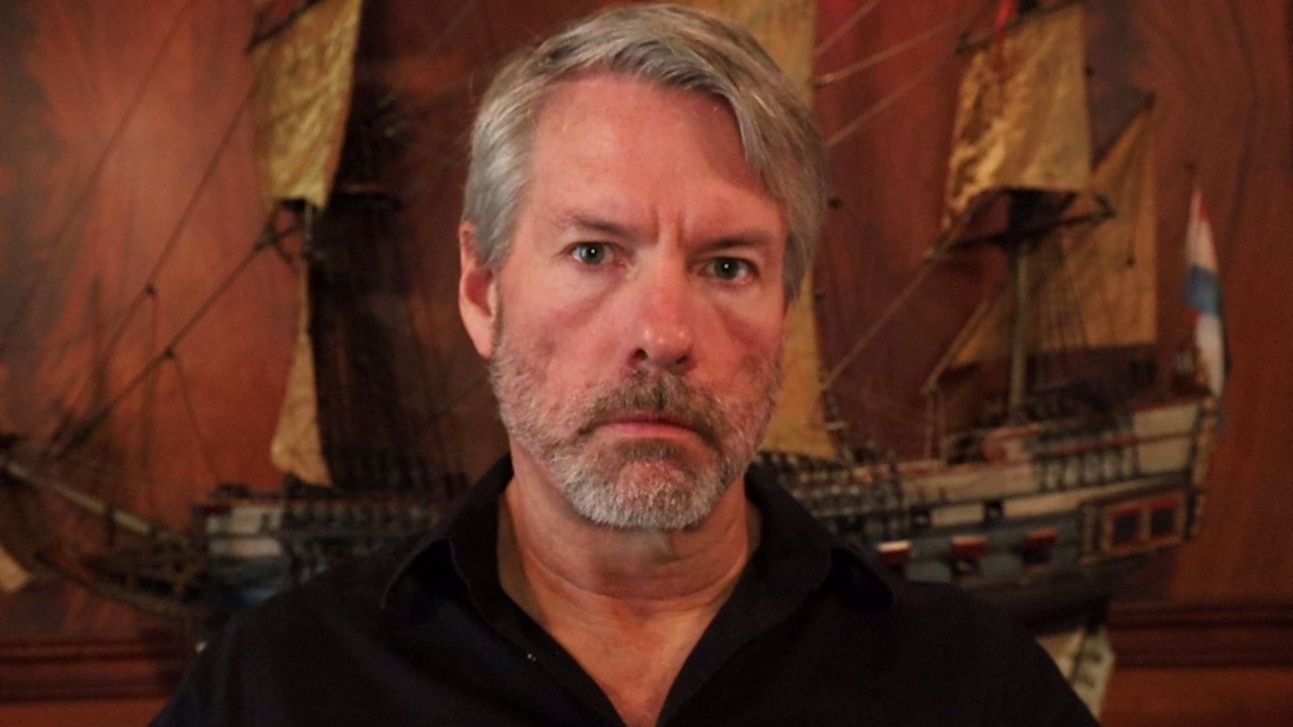

The Bitcoin Rush: MicroStrategy’s Major Bet and Market Implications

Overview or Introduction

As Bitcoin reaches new heights, MicroStrategy has positioned itself as a significant player in the cryptocurrency arena. Recently, the company made headlines again by boosting its holdings to a staggering 439,000 BTC. This article explores MicroStrategy’s remarkable investment strategy, the impact of fair value accounting, and what it means for the future of Bitcoin and corporate investments in digital assets.

With the Bitcoin market at an all-time high and MicroStrategy’s latest actions, it’s essential to understand the implications of these moves for investors and the broader market.

MicroStrategy’s Bold New Acquisition

On December 15, 2024, MicroStrategy completed its purchase of 15,350 BTC for approximately $1.5 billion, bringing its total Bitcoin holdings to 439,000 BTC, valued at around $45.6 billion based on current market prices. This acquisition marked a significant investment, priced at an average of $100,386 per Bitcoin, offering insights into MicroStrategy’s aggressive growth strategy in cryptocurrency investments.

The company utilized funds generated from its at-the-market (ATM) share sales program to finance this investment. Following this purchase, MicroStrategy has around $7.65 billion remaining in its ATM offering, indicating its continuous push into Bitcoin amidst bullish market conditions.

Regulatory Changes and Market Reactions

Adding to the significance of MicroStrategy’s actions is the recent adoption of fair value accounting standards for digital assets by the Financial Accounting Standards Board (FASB). As of December 15, 2024, companies can recognize changes in the fair value of Bitcoin holdings in their net income, a shift from previous standards that only allowed for recognition of impairments.

This change could lead to larger corporate investments in Bitcoin and bolster the cryptocurrency’s legitimacy as a viable asset class, potentially driving prices even higher as companies feel more confident in including it in their financial statements.

Market Reactions and Future Outlook

The announcement of MicroStrategy’s latest acquisition led to a 4% increase in its share price in pre-market trading, demonstrating investor enthusiasm in response to the company’s strategic moves. Simultaneously, Bitcoin has been trading above $104,000, having recently set an all-time high surpassing $106,000.

As MicroStrategy solidifies its status as a ‘Bitcoin whale,’ the question remains: what does this mean for other corporate players in the cryptocurrency space? Analysts predict that more companies will follow suit, especially with the favorable regulatory landscape evolving. The trend could signify a transformative shift in corporate investment strategies toward digital assets.

Key Takeaways

- MicroStrategy has increased its Bitcoin holdings to 439,000 BTC, investing $1.5 billion in its latest purchase.

- The new fair value accounting regulation could enable companies to recognize gains in their investments, attracting more corporate players to Bitcoin.

- Market reactions indicate strong investor confidence in MicroStrategy’s strategic direction and the overall potential of Bitcoin.