Bitcoin’s Resurgence: What the Revival Means for the Altcoin Market

Overview or Introduction

As Bitcoin taps into the $100,000 mark once more, the ripple effects are felt across the broader cryptocurrency market. This article dives into the recent case of Bitcoin’s bullish trajectory and how major altcoins like Ethereum, XRP, and Solana are riding this wave of renewed investor confidence. Understanding this momentum is essential for any crypto investor looking to navigate the turbulent waters of this volatile market.

The resurgence of Bitcoin comes at a pivotal time as investors weigh macroeconomic indicators and regulatory changes that can influence market dynamics. What does this mean for altcoins and their potential growth? Let’s explore the impact of Bitcoin’s gains on the crypto landscape.

Bitcoin’s Bullish Momentum

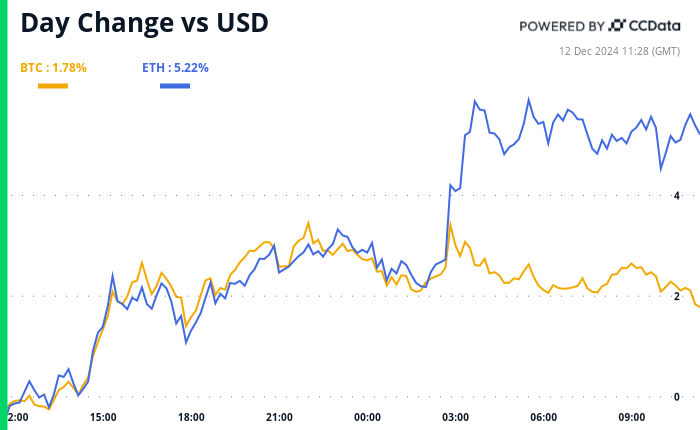

Bitcoin regained the $100,000 threshold driven by favorable economic indicators, notably matching inflation estimates that prompted widespread market optimism. With Bitcoin approaching all-time highs, such as the peak of $103,679, institutional interest is burgeoning. This uptick signals the market’s trust in sustained growth, even as price fluctuations remain prevalent.

The correlation between Bitcoin’s performance and its dominance over the cryptocurrency market is evident. When Bitcoin rises, institutional investors often take part, with the newly introduced Bitcoin ETFs witnessing unprecedented inflows, amounting to $3.85 billion last week. This trend suggests that traditional investors are increasingly seeking exposure to cryptocurrencies as a hedge against inflation.

Ripple Effects on Altcoins

The altcoin market is not lagging behind; in fact, it often mirrors Bitcoin’s momentum. Ethereum, riding on the optimism surrounding Bitcoin, is anticipated to breach the $5,000 mark, bolstered by increasing on-chain activities that lead to token burn and a reduction in supply. This diminishing supply bodes well for price stability and potential appreciation in value.

Moreover, XRP is enjoying significant gains, surging by 17% amidst a growing demand following news about its upcoming stablecoin. Similarly, other altcoins, including Solana and Dogecoin, are witnessing double-digit percentage increases, fueled by investor enthusiasm stemming from Bitcoin’s resurgence. Token ecosystems in this area are rapidly evolving, culminating in price jumps across many altcoin portfolios.

The Importance of Macro Indicators

The influence of macroeconomic indicators cannot be understated in their effect on cryptocurrency markets. As the Federal Reserve signals a potential rate cut, this aligns with lower interest rate environments, which traditionally favor riskier assets. Lower interest rates can enhance the attractiveness of cryptocurrencies as investors seek higher returns than those available from traditional assets.

Furthermore, positive macro announcements, such as the recent U.S. inflation report, contribute to sustaining investor momentum. These indicators highlight the interconnection between traditional economic conditions and the cryptocurrency market, reinforcing the need for prospective investors to stay informed about broader economic narratives.

Key Takeaways

- Bitcoin’s recent surge past $100,000 showcases renewed investor confidence, supported by favorable macroeconomic indicators.

- Altcoins like Ethereum, XRP, and Solana are significantly benefiting from Bitcoin’s momentum, with many experiencing substantial price increases.

- The correlation between macroeconomic trends and cryptocurrency performance is crucial, especially regarding interest rates and inflation data.

- Investors should remain vigilant and informed, leveraging macro insights to make strategic decisions in an increasingly dynamic market.