Introduction

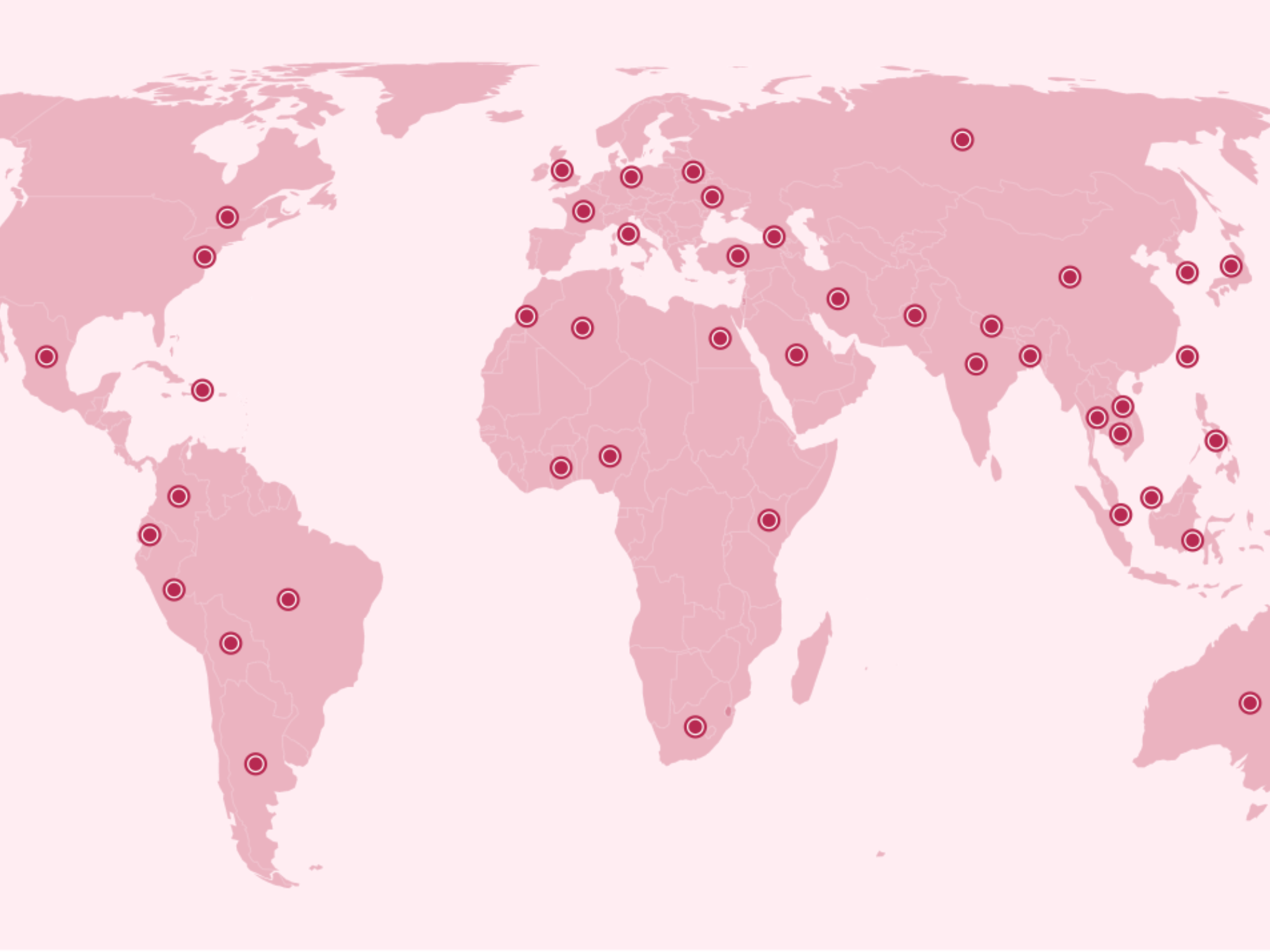

As the cryptocurrency landscape evolves from a largely unregulated territory to one marked by growing oversight, countries worldwide are scrambling to establish frameworks that govern this burgeoning sector. With a series of high-profile collapses and the rapid integration of digital currencies into mainstream finance, understanding the patchwork of regulations is more crucial than ever for investors and consumers alike.

The United States: Attempted Frameworks and Legal Battles

The U.S. is in a continuous state of flux when it comes to cryptocurrency regulations. While the framework introduced in 2022 acknowledges existing regulatory bodies like the SEC and CFTC, ongoing legal battles highlight the complexities involved. Recent court rulings have provided some clarity, including the differentiation between securities and commodities in crypto transactions, yet the regulatory path remains uncertain. The SEC continues to assert its authority over the industry, aiming for compliance even as it faces challenges in navigating the evolving landscape.

Europe: Pioneering Comprehensive Regulation

The European Union has become a leader in cryptocurrency regulation, particularly with its MiCA framework, enacted in May 2023. This legislation creates rigorous guidelines for companies dealing in cryptocurrencies, with mandates for transparency and accountability designed to protect consumers and prevent illicit activities. As nations within the EU implement these rules, the drive for a unified regulatory approach is showcased as a model for global standards.

Asia: A Diverse Landscape of Regulations

Asia presents a varied approach to cryptocurrency. Nations like Japan and South Korea are making strides in regulation, focusing on consumer protection and security. However, strict regulations prevail in China, where cryptocurrencies are outright banned, showcasing a cautionary stance toward the asset class. Meanwhile, India grapples with its regulatory stance, oscillating between bans and legal frameworks, leading to uncertainty among users.

Latin America: Bright Spots Amid Gigantic Shadows

In Brazil, new regulations established in 2023 position the central bank as the primary regulatory body for crypto activities. This move came as a response to rising interest in digital currencies among the Brazilian populace, emphasizing the shift toward general acceptance and usage in payments. Other nations in Latin America exhibit similar trends as interests in cryptocurrencies rise alongside regulatory efforts to control potential abuses.

Global Recommendations and Future Directions

As countries move toward regulation, organizations like the International Organization of Securities Commissions are promoting broader compliance and consistency in crypto regulation. These global recommendations underline the necessity for cooperation across borders to mitigate risks to investors and enhance regulatory alignment, paving the way for a cohesive global strategy on cryptocurrency.

Key Takeaways

- The U.S. struggles to establish a clear regulatory framework amidst ongoing litigation.

- The EU has set a precedent with comprehensive regulations that prioritize consumer protection.

- Asia showcases both rapid innovation and significant regulatory challenges, particularly in China.

- Latin America, led by Brazil, is increasingly adapting to the maximal interests in cryptocurrency usage.

- Global cooperation and standardization are essential to mitigate risks and promote safe cryptocurrency practices across international borders.