Introduction

The cryptocurrency market has entered a critical phase as Bitcoin (BTC) inches towards the $100,000 mark, reflecting a complex interplay of retail interests, profit-taking by long-term holders, and altcoin enthusiasm. With key metrics suggesting a possible mid-bull cycle peak, investors are keeping a keen eye on market fluctuations as they navigate this volatile landscape.

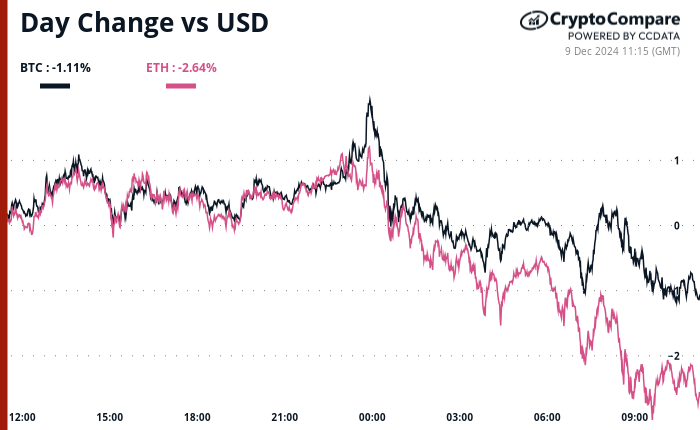

Bitcoin’s Performance

Starting the week on a bearish note, Bitcoin has been fluctuating around the $100,000 threshold, facing pressure from market dynamics and social media reactions. Recent observations indicate a peak in profit-taking behavior, with Bitcoin’s value days destroyed (VDD) jumping to 2.0 from earlier lows, hinting at increased selling activity among seasoned investors. While this behavior often suggests an impending market rollover, current metrics remain below critical threshold levels that marked the end of previous bull cycles.

Retail Interest in Altcoins

Despite Bitcoin’s struggles, retail interest has noticeably shifted towards altcoins, particularly Ethereum (ETH). Open interest in Ether perpetuals has outpaced Bitcoin, with significant inflows into Ether ETFs. The DeFi sector is also thriving, spurred by surging trade volumes and reduced inflation rates for Ether.

Market Reactions and Upcoming Events

Prominent market players like MicroStrategy’s CEO, Michael Saylor, have ignited discussions surrounding Bitcoin as an alternative reserve asset for the U.S. Meanwhile, the crypto community remains abuzz with attention on upcoming events such as Microsoft’s annual shareholders meeting, which will feature significant discussions surrounding Bitcoin and its strategic importance in financial portfolios.

Key Market Indicators

Market behaviors suggest a recognition of Bitcoin’s potential resistance levels with the options market indicating call premiums for significant strike prices. This speculative interest indicates traders are anticipating further price movements despite recent fluctuations.

Key Takeaways

- Bitcoin’s price dynamics suggest a potential mid-cycle peak amid increasing retail participation.

- Ethereum has seen a surge in interest, especially with notable growth in the DeFi sector.

- Crucial upcoming events could reshape the crypto landscape and investor sentiment.