Introduction

The world of cryptocurrency is ever-changing, and as 2024 draws to a close, the current market dynamics reflect a heightened cautiousness among investors. Bitcoin and Ether’s prior bullish momentum hits a stumbling block as economic indicators and upcoming Federal Reserve decisions loom large over the market.

Market Sentiment Dips Amid Economic Indicators

The release of the U.S. Producer Price Index (PPI) has sent ripples through the crypto market, revealing a hotter-than-expected inflation scenario that prompts investors to favor the dollar. The Truflation index, considered more reliable by some analysts, showing a rise above 3% for the first time in over two years, adds to the prevailing uncertainty.

Future Fed Actions Shape Trading Strategies

Despite the troubling PPI data, futures markets hold a bullish expectation that the Federal Reserve may cut rates by 25 basis points next week. Decentralized traders are exhibiting optimism, reflected in substantial open interest for BTC call options. The disparity between call and put options highlights a persistent bullish outlook in segments of the market.

Key Tokens and Their Movements

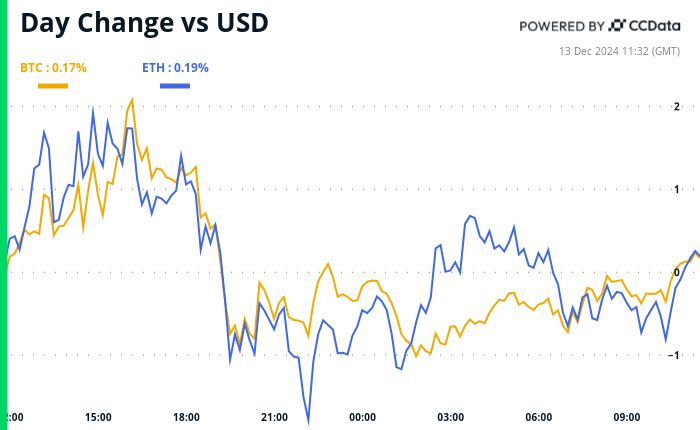

Noteworthy movements include Bitcoin (BTC), which closed recently at $100,468.14, a slight increase over the previous day. Ether (ETH), on the rise at $3,899.63, and other tokens like LQTY and AVAX display mixed sentiment driven by broader market conditions. The upcoming Avalanche9000 upgrade adds another layer of intrigue as it aims for enhanced platform functionality.

Exploring Alternative Investments

Surveys among investors, especially in emerging markets, reveal a propensity to shift towards altcoins amid increased volatility stemming from geopolitical and local economic pressures. This shift hints at a potential altcoin season as traders seek diversification in their portfolios.

Token Launches and Events on the Horizon

As the market gears up for significant events in December, including the Nasdaq-100 index changes and various token unlocks, traders and investors are advised to keep an eye on these developments that could signify increased activity and volatility in the crypto space.

Key Takeaways

- Market response to recent economic data shows investor caution.

- The expectation of a Fed rate cut might provide support for crypto assets.

- Continuing bullish sentiment is evident in trading activity, particularly in call options.

- Emerging markets are pivoting towards altcoins, anticipating a shift in investment strategies.