Introduction

The cash advance services market has seen significant growth amid economic turbulence and a rising demand for immediate credit options. As consumers face mounting financial pressures, the emergence of fintech partnerships is reshaping the landscape of traditional finance.

Market Overview

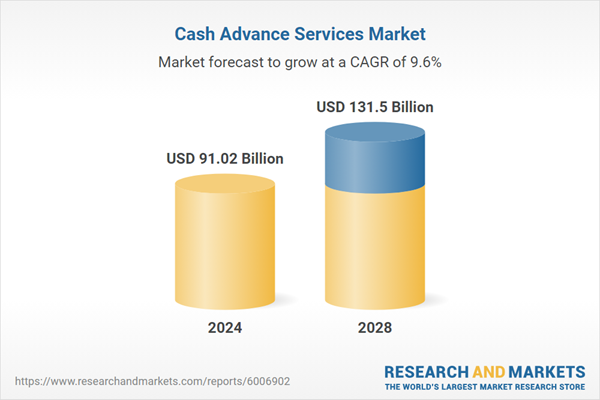

The cash advance services market is anticipated to grow from $83.26 billion in 2023 to $91.02 billion in 2024, reflecting a compound annual growth rate (CAGR) of 9.3%. This growth trend is fueled by economic instability, high consumer debt levels, and limited access to conventional credit. Predictions indicate a further increase to $131.5 billion by 2028, driven by a shift toward fintech solutions and alternative credit products.

Key Drivers of Growth

Rising consumer demand for quick financial solutions, coupled with the expansion of fintech companies, is a significant contributor to the market’s growth. The increasing use of digital platforms has made cash access more convenient, while artificial intelligence integration enhances credit assessment processes. Flexible repayment options and improved regulatory frameworks further support this sector’s expansion.

Emerging Trends

Some notable trends include the growing popularity of point-of-sale (POS) cash advances, bolstered by innovative fintech offerings. For example, SumUp’s recent introduction of a cash advance solution for merchants indicates a shift towards more tailored financial services. Additionally, the rise of partnerships between fintech firms and legacy financial institutions is setting the stage for a more integrated financial ecosystem.

Regional Insights

North America emerged as the largest market for cash advance services in 2023, with significant contributions from several key players across various regions including Europe and Asia-Pacific. The demand for immediate cash solutions and the proliferation of credit and debit card usage are evident throughout these areas.

Future Projections

The cash advance services market is positioned for strong growth through 2028, driven by fluctuating consumer confidence and ongoing economic challenges. The anticipated rise in demand for instant cash access reflects broader trends in consumer behavior and financial management.

Key Takeaways

- The cash advance services market is expected to reach $131.5 billion by 2028, showcasing robust growth.

- Fintech partnerships with traditional banks are central to the evolution of cash advance offerings.

- Digital platforms and AI are improving consumer access and experience in the cash advance sector.