Introduction

As Bitcoin and XRP reach historical price heights, traders find themselves navigating uncharted waters, striving to identify pivotal resistance levels. With Bitcoin hovering near the $100,000 milestone and XRP showing promise at $2.44, understanding market behavior becomes crucial for both new and seasoned investors.

Bitcoin: Charting New Territories

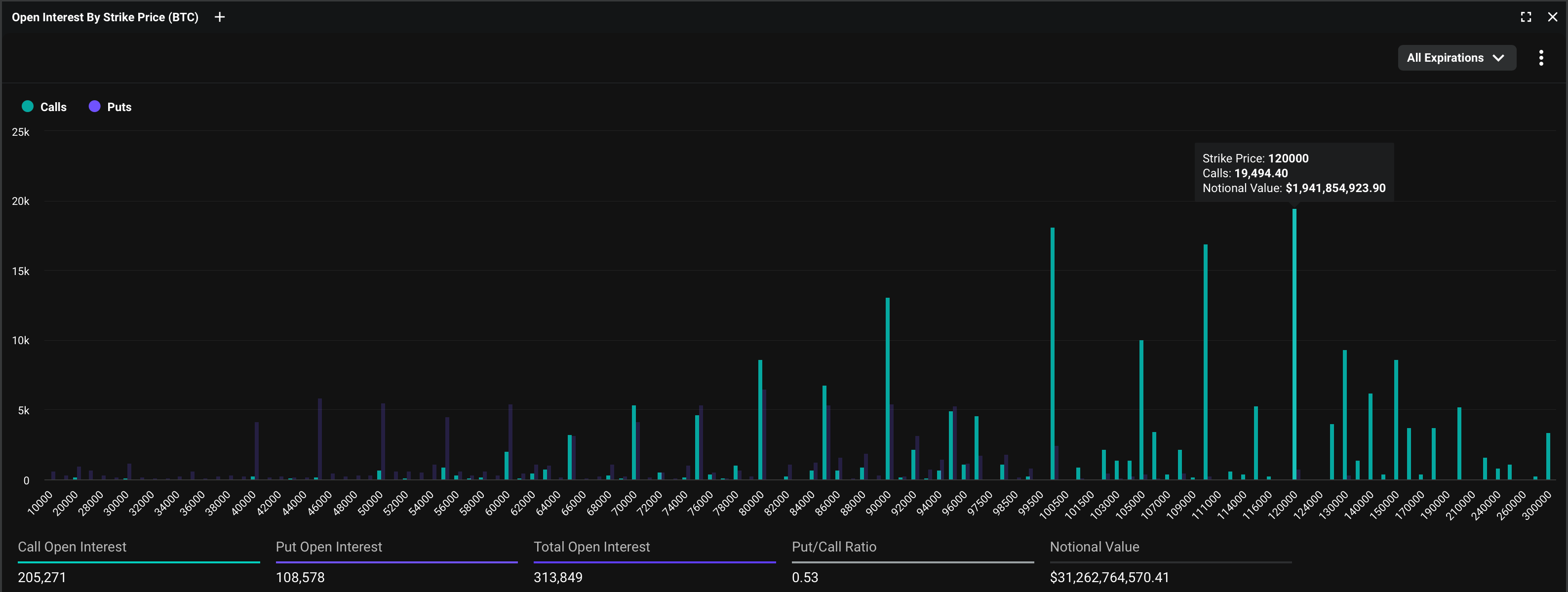

Bitcoin, the cryptocurrency titan, is trading at record levels, a development that signals the importance of identifying resistance points—price thresholds where potential price corrections may occur. The focus is on open interest in options as a method for pinpointing these levels. The data reveals that the $120,000 strike call option leads with a staggering open interest of $1.93 billion, indicating a potential price resistance as sellers work to keep prices below this benchmark.

Key Options and Institutional Activity

The $100,000 call option still stands as a significant reference point with $1.8 billion in open interest. This suggests that institutions are keenly aware of the market dynamics at this level and play a crucial role in determining price movement. Additionally, the presence of substantial open interest in both the $110,000 and $200,000 strike calls reflects a broader optimistic sentiment among traders looking at future price trajectories.

XRP’s Resistance Landscape

XRP traders also experience a similar situation with a primary focus on the $1 call option, which is currently deep in-the-money with $3 million in open interest. As XRP trails behind Bitcoin, its next resistance anticipations are pegged at approximately $2.8, with the market eyeing the higher stakes of hitting the $5 mark in the future.

Technical Insights and Future Projections

Understanding resistance levels isn’t merely a matter of charts; it’s also about the collective sentiment of the market’s participants. Analysts predict a robust future for Bitcoin, indicating prices may reach the $200,000 mark by 2025. The consensus around XRP remains cautious yet hopeful, with traders mirroring similar speculative strategies associated with potential price movements.

Key Takeaways

- Bitcoin’s primary resistance level is observed at the $120,000 strike call option with $1.93 billion in open interest.

- XRP’s immediate focus lies at the $2 mark, with potential resistance assessed at $2.8 and $5.

- Understanding open interest is crucial for predicting future price movements in cryptocurrencies.

- Market sentiment leans bullish on Bitcoin’s long-term trajectory, while optimism surrounding XRP remains guarded.