Introduction

As the holiday season approaches, anticipation in the crypto market has been overshadowed by sudden shifts in monetary policy. With the Federal Reserve’s recent announcements, the hopes of a calm Christmas rally in Bitcoin prices have been dashed, leaving investors and traders wondering about the implications for the future.

Fed’s Impact on Crypto Markets

Fed Chair Jerome Powell’s recent statements distancing the central bank from potential changes linked to the incoming presidential administration have raised concerns among crypto traders. Many are now expected to remain on the sidelines until the new government’s strategies become clearer, leading to reduced market activity.

Interest Rate Projections

The Fed’s projection of only two rate cuts in 2025, coupled with rising concerns over inflation and labor market strength, has prompted speculation regarding the sustainability of low long-term interest rates. The recent breakout in the 10-year Treasury yield further complicates the market landscape, affecting risk assets, including cryptocurrencies.

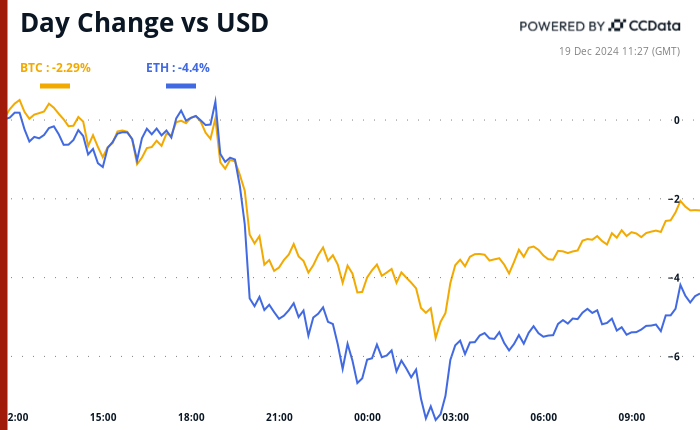

Market Volatility and Crypto Trends

Despite recent dips, the general outlook on cryptocurrencies remains cautiously optimistic. Analysts predict increased volatility as traders adjust to the evolving political and economic climate. High-yield crypto assets are beginning to draw interest as safe havens, reflecting ongoing changes in market sentiment.

Future Outlook and Investment Opportunities

While short-term challenges loom, long-term growth potential for Bitcoin and Ether remains intact. Observers are keeping a keen eye on innovative tokens, particularly those linked to AI technologies within the blockchain space, suggesting new avenues for investment as the market matures.

Key Takeaways

- Fed’s distancing from crypto-related initiatives has created uncertainty among investors.

- Upcoming interest rate changes could heavily influence crypto market performance.

- Investors may look to high-yield assets and AI tokens for opportunities amidst volatility.