Introduction

The rhodium market is on a precipice of significant growth, driven by demand from the automotive sector and emerging technologies. As global emissions standards tighten and sustainability concerns mount, the precious metal is carving out a vital role in vehicle emissions control and various industrial applications.

Market Overview

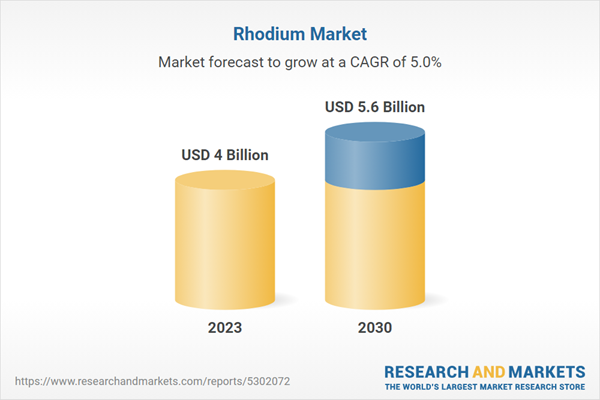

As of 2023, the global rhodium market is valued at a remarkable US$4.0 billion, with projections indicating a climb to US$5.6 billion by 2030, reflecting a compound annual growth rate (CAGR) of 5.0%. This growth trajectory is fueled by several factors including regulatory pressures, technological advancements, and shifting consumer preferences towards sustainable practices.

Drivers of Growth

Chief among the catalysts for rhodium’s market growth is the automotive sector’s push to meet stringent emissions standards, which has led to an increased reliance on rhodium in catalytic converters. As nations worldwide implement tighter regulations aimed at reducing carbon emissions, the demand for rhodium continues to soar, especially in regions with the most severe environmental mandates.

Additionally, rhodium’s unique attributes—such as high corrosion resistance and thermal stability—are fostering its adoption in innovative applications beyond automobiles, including renewable energy systems and various high-performance components.

Supply Constraints and Market Dynamics

The rhodium market is uniquely impacted by its supply-side dynamics. The concentration of its mining sources—primarily in South Africa—coupled with complex extraction processes, results in a limited and often unstable supply chain. Geopolitical risks and labor unrest in these regions further complicate matters, typically leading to increased prices in response to supply disruptions.

High Demand Across Various Sectors

Consumer awareness regarding sustainability has amplified the demand for eco-friendly automotive solutions, creating an urgent requirement for materials like rhodium that meet environmental compliance. The metal is also gaining traction in sectors such as jewelry, industrial applications, and chemical processing, all of which are navigating a rising tide of interest and investment in sustainable and high-quality materials.

Regional Insights and Competitive Landscape

The U.S. rhodium market is currently valued at approximately $1.1 billion and is projected to expand substantially, just as the Chinese market, which is expected to achieve a CAGR of 8.4% and reach $1.2 billion by 2030. Such insights draw back the curtain on emerging growth trends across global markets, highlighting critical players like African Rainbow Minerals Ltd., Anglo American Platinum Ltd., and others who are actively shaping the landscape.

Key Takeaways

- The global rhodium market is set for significant growth, expected to reach US$5.6 billion by 2030.

- A key driver of this expansion is the rising regulatory focus on reducing vehicle emissions.

- Supply constraints from mining operations primarily in South Africa are likely to push prices higher.

- Consumer trends towards sustainability are bolstering demand across multiple industries.