Introduction

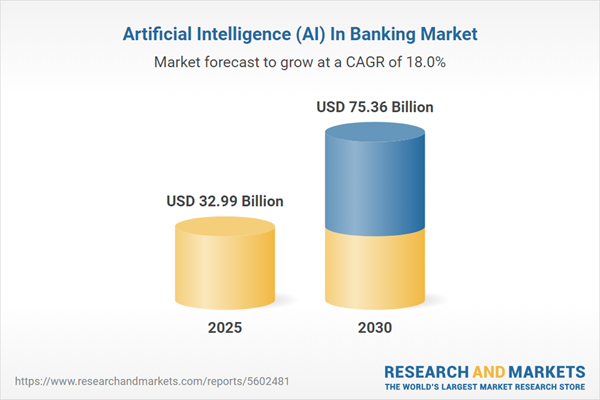

The banking sector is on the brink of a seismic shift driven by the adoption of artificial intelligence (AI), projected to grow to $75.36 billion by 2030. This dramatic increase is not just a projection; it speaks to the pivotal role AI will play in reshaping customer relationships, operational efficiencies, and competitive strategies in banking.

The Transformative Impact of AI

According to a new report, AI in banking is estimated to grow at a compound annual growth rate (CAGR) of 17.96%, up from $32.99 billion in 2025. Central banks are encouraged to embrace AI, acknowledging its far-reaching impact on economies and the banking framework. Enhanced fraud detection, personalized customer service, and optimized operational capabilities are just a few transformative aspects driving this growth. Companies like Zest AI are leading the charge, with innovative solutions such as Zest Protect that swiftly identify fraudulent activities during loan applications.

Digital Payments: A Catalyst for Change

The surge in digital payments is a key driver of AI adoption in banking. A remarkable 44% annual growth in digital payment transactions in India underscores this trend. As banks aim to streamline customer interactions through mobile applications, AI’s role in analyzing vast customer data becomes critical. This evolution not only enhances service delivery but also deepens banks’ understanding of individual customer needs, fostering a more personalized banking experience.

The Global Landscape of AI in Banking

The Asia-Pacific region, particularly China, is at the forefront of AI integration in banking. A major survey revealed that 83% of Chinese banks are employing generative AI, positioning them distinctly compared to an average of 54% globally. This rapid adoption is attributed to the necessity to diversify income sources and reduce dependence on net interest income, which is sensitive to central bank adjustments. With automation expedited by AI, banks are enhancing their operational efficiency while making millions of decisions daily.

Strategic Implications and Future Trends

As financial institutions seek to navigate this evolving landscape, strategic maneuvers are essential. Insights from detailed market analysis reveal that diversification, innovative customer engagement, and operational automation via AI will be crucial for banks aiming to maintain a competitive edge. Key players, including industry giants like IBM and Accenture, are leveraging their resources to explore new growth avenues in this dynamic market.

Key Takeaways

- AI in banking is set to grow substantially, reaching $75.36 billion by 2030.

- The rise of digital payments is pushing banks to adopt AI for enhanced customer interactions.

- Asia-Pacific, particularly China, is leading the global AI banking landscape.

- AI integration is critical for improving security measures and operational efficiencies.

- Strategic adaptations will be essential for banks to thrive in a technology-driven future.