Introduction

The volatile landscape of cryptocurrency is once again under scrutiny as China’s economic struggles coincide with fluctuations in Bitcoin’s value. As bonds yield historic lows, investors are left wondering: is this the beginning of a bullish turn for digital assets or a harbinger of more trouble ahead?

The Impact of China’s Economic Performance

Recent reports show that China’s one-year government bond yield has plummeted below 1%, the first time since the Great Financial Crisis. This economic downturn could trigger significant responses from Beijing, likely leading to substantial stimulus efforts. Analysts believe that issues like deflation and increasing government debts prompt a reassessment of monetary policy not just in China, but globally. This context has broad implications, especially for risk-sensitive assets such as Bitcoin, which recently fell below $95,000.

Fed Policy and its Ripple Effect

In the U.S., Fed Chairman Jerome Powell’s comments on interest rates have influenced market conditions dramatically, causing Bitcoin’s price to tumble. With China’s economic trends suggesting potential deflation and questions surrounding inflation in the U.S., many experts propose that Powell’s inflation fears might be misplaced. With decreasing core goods inflation attributed to China, we may witness a reconsideration of the U.S. rate policy moving forward, possibly resulting in more than the projected two rate cuts by 2025.

Current Market Sentiment

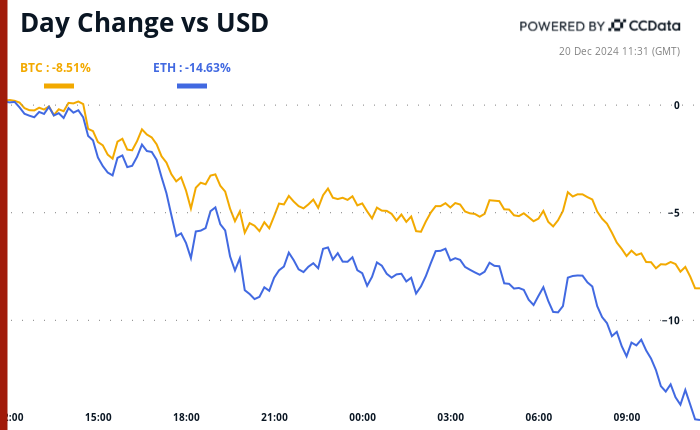

As of now, the market reaction has been relatively bleak. Major cryptocurrencies are predominantly in the red, with Bitcoin testing support levels, prompting observers to forecast considerable selling pressure ahead. The recent volatility shows a stark contrast as futures linked to the S&P 500 yield a similarly downcast outlook, mirroring the turbulent waters in the crypto space.

What Lies Ahead for Crypto Traders

Upcoming economic reports, particularly the core PCE index, will be crucial for investors keen on understanding the Fed’s next moves. A higher than expected inflation reading may diminish the chances for another rate cut, leaving traders on edge. Furthermore, with key events, including the inclusion of MicroStrategy in the Nasdaq-100 Index and regulatory updates from the EU, the landscape will be intricate, requiring astute monitoring by crypto exchanges and traders alike.

Key Takeaways

- China’s bond yields are at historic lows, urging potential stimulus measures.

- The relationship between U.S. Fed policy and Bitcoin prices is tense, with experts urging a reevaluation of inflation concerns.

- Current market sentiment in the crypto sector is predominantly negative, with significant selling pressure observed.

- Key economic indicators and upcoming regulatory changes could significantly impact future market movements.