Introduction

The cryptocurrency markets are poised for critical movements as they await the release of the U.S. Consumer Price Index (CPI) data on January 15, 2025. With Bitcoin’s price stabilizing and other assets like XRP and various AI coins showing significant activity, traders are cautiously positioning their strategies in an uncertain economic environment.

Market Sentiment and Predictions

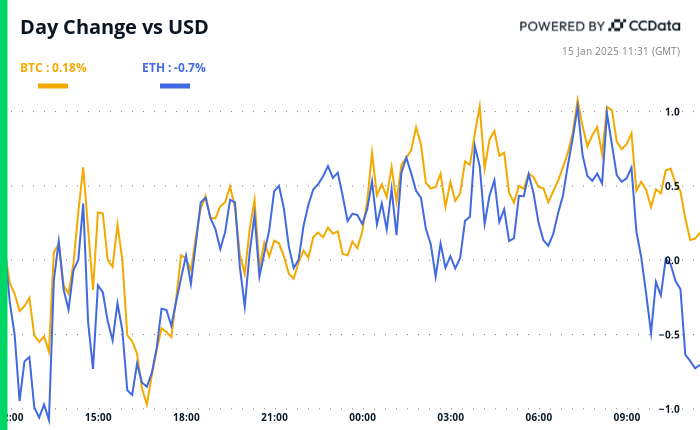

The anticipation surrounding the upcoming CPI report is palpable among traders, especially with concerns about hawkish Federal Reserve responses. Experts from firms such as QCP Capital and 10x Research highlight the impact of market volatility on Bitcoin (BTC) as it correlates increasingly with tech stocks. BTC options are reflecting cautious sentiment, with traders opting for short-dated puts given the potential for downsides.

XRP’s Surge and AI Coin Activity

XRP has demonstrated resiliency, climbing to $2.90 and nearing its December high as technical indicators suggest a further uptick. Concurrently, AI-focused cryptocurrencies—some of which have been drawing attention from dip buyers—could capitalize on renewed risk appetite in the wake of CPI data. Tokens like FAI, GRASS, VIRTUAL, Ai16z, and TAO are among those highlighted for potential recovery and growth.

What to Watch in the Coming Days

Several notable events in the crypto and macroeconomic space are scheduled for the upcoming days. Key dates include important court hearings related to crypto regulation and major upgrades in blockchain technology, all of which could influence market movements. With significant liquidity events such as token unlocks and governance discussions taking place, the landscape remains dynamic.

Key Takeaways

- Upcoming U.S. CPI data is expected to influence cryptocurrency market dynamics significantly.

- XRP is poised for further growth, matching its December high, while AI coins show increased trading activity.

- Cautious market sentiment is prevalent as traders prepare for potential volatility amidst macroeconomic changes.