Introduction

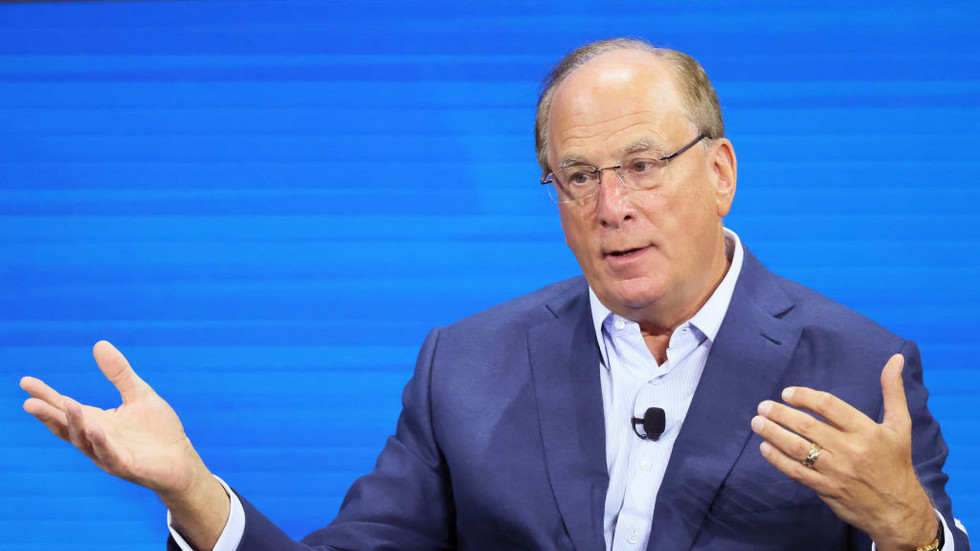

In a striking announcement that could reshape the cryptocurrency landscape, Larry Fink, CEO of BlackRock, has projected that Bitcoin could skyrocket to an incredible $700,000 if institutional investors allocate a mere 2% to 5% of their portfolios to the digital asset. This provocative forecast comes amidst a remarkable surge in Bitcoin’s value, which has exploded by 121% in 2024 alone, underscoring a growing momentum towards institutional adoption.

The Current Bitcoin Landscape

After reaching a record price of $109,225 following the inauguration of President Donald Trump, Bitcoin appears to be entering a new phase of legitimacy and acceptance among financial giants. Fink, speaking at a recent panel in Davos, emphasized Bitcoin’s potential not only as an investment vehicle but also as a hedge against economic uncertainty, echoing sentiments shared by institutional investors contemplating significant allocations.

Institutional Interest and Market Impact

Fink revealed that conversations with sovereign wealth funds have turned to the inclusion of Bitcoin in their portfolios. His prediction hinges on the idea that if more institutions adopt such allocations, we will see Bitcoin’s price potentially escalating to unprecedented levels. While he dismisses the notion of actively promoting Bitcoin, his bullish outlook reflects a significant shift in sentiment within traditional finance.

Bitcoin’s Evolution in the Financial System

Bitcoin, launched in 2009, fundamentally transformed digital transactions by allowing individuals to transfer value without relying on banks or governments. However, its rise has been accompanied by concerns about its volatility and the implications of its decentralized nature. Fink’s acknowledgment of Bitcoin’s potential comes against a backdrop of increasing scrutiny from governments wary of how cryptocurrencies are utilized.

Concerns About Regulation and Authenticity

Despite its growing acceptance, Bitcoin’s institutionalization raises concerns about whether it could compromise its foundational ethos as “freedom money.” Critics argue that regulatory and economic controls could undermine Bitcoin’s decentralized nature, as noted by financial analyst Susie Violet Ward. The ongoing debate around Bitcoin reflects broader tensions regarding the balance between regulation and the original ideals of cryptocurrencies.

Key Takeaways

- Larry Fink predicts Bitcoin could reach $700,000 with substantial institutional investment.

- The cryptocurrency has surged over 121% in value in 2024, breaking previous records.

- Institutional investors are increasingly considering Bitcoin as part of their portfolios.

- Concerns regarding the potential regulation of Bitcoin could impact its decentralized nature.