Introduction

The narrative surrounding MicroStrategy has evolved from a visionary data mining company to a controversial player in the cryptocurrency sphere. With mounting concerns over the sustainability of its Bitcoin-centric strategy, this article delves into the historical trajectory, current strategies, and potential downfall of MicroStrategy as it stands on the precipice of financial chaos.

The Before Times

Founded in 1998, MicroStrategy aimed to revolutionize data analytics during the tech boom. Under CEO Michael Saylor, the company thrived by providing cutting-edge software that helped businesses harness their data. This initial success set the stage for what would be a tumultuous journey through the dotcom crash and beyond.

The Exploration Era

After years of stagnation, MicroStrategy shifted its focus towards Bitcoin in 2020. Purchasing massive amounts of Bitcoin, the company’s transition from software to cryptocurrency was unexpected. As Saylor played up the potential of Bitcoin, investors began to buy into the narrative, leading to a reevaluation of the company’s worth.

The Golden Age

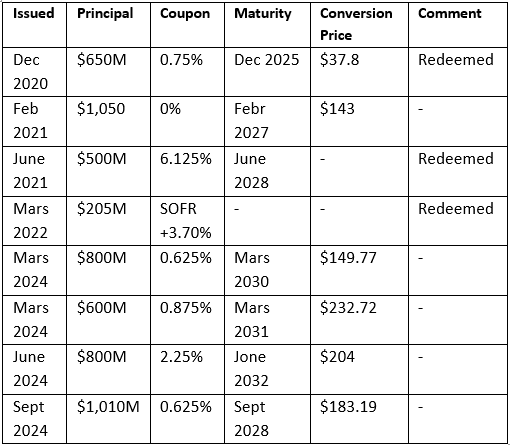

MicroStrategy’s strategic shift established it as a “Bitcoin Treasury Company,” drawing in investors eager for cryptocurrency exposure. The company published ambitious plans for growth, continuously raising capital through various bond offerings, banking on the assumption of sustained Bitcoin price increases to bolster its valuation.

The Foundation Shakes

As MicroStrategy’s stock price became increasingly detached from the underlying value of its Bitcoin holdings, critics began questioning the validity of its strategies. The narratives surrounding cheap debt, leveraged investments, and regulatory arbitrage painted a picture of an unsustainable growth model that could readily collapse under financial scrutiny.

The Coming Fall

With signs of market instability looming, investors are left to wonder how long MicroStrategy can maintain its façade of success. As the company’s operational strategies become increasingly precarious, a potential unraveling of its perceived value model may be on the horizon, fueling fears of a catastrophic collapse.

Key Takeaways

- MicroStrategy’s historical transformation from data analytics to crypto speculation raises questions about sustainability.

- Investors are currently caught in a precarious dynamic of inflated valuations and unsustainable growth narratives.

- Potential market downturns could have disastrous implications for the company’s debt-laden strategies.