Altcoins Ascending: The New Era of Digital Assets

Overview or Introduction

The cryptocurrency landscape is shifting dramatically as Bitcoin breaches the monumental $100,000 mark, signaling not only a mainstream acceptance of digital currencies but also opening the gates for a promising wave of altcoins. This report delves into the emerging view of altcoins as viable investment opportunities, transforming from mere alternatives to major players in a complex digital asset class.

As traditional categorization fades, understanding the diverse and vibrant world of altcoins becomes crucial for investors looking to diversify and enhance their portfolios. This article explores top players in the altcoin market, highlighting their potential just as the entire market begins to soar.

The Transformative Shift in the Cryptocurrency Market

Recent developments within the crypto environment hint at a transformative phase. Following the recent U.S. elections, numerous regulations have shifted in favor of cryptocurrency, with key players like Paul Atkins and David Sacks entering pivotal positions. Market sentiment is leaning towards an “altcoin season,” as sectors within digital assets increasingly reflect their own identities rather than being overshadowed by Bitcoin.

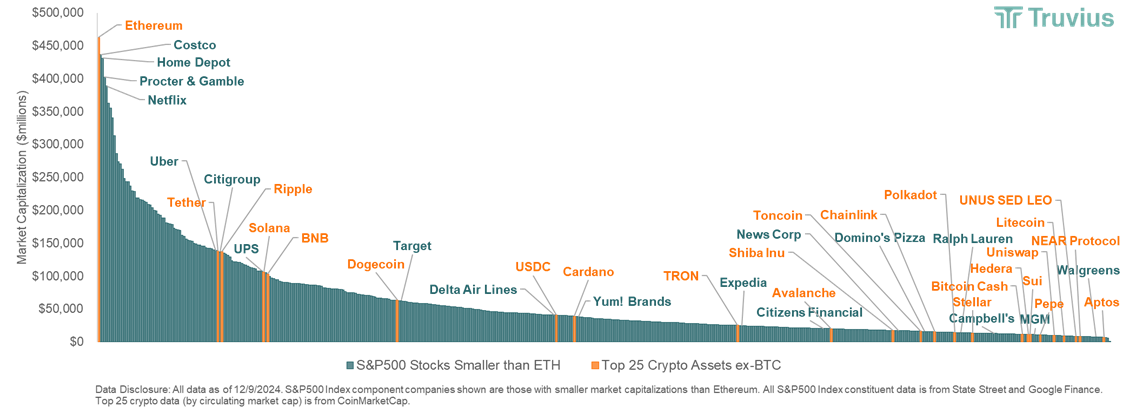

This evolution from a simplistic binary classification—Bitcoin versus “altcoins”—to a more nuanced understanding of a multi-sector asset class reflects significant growth in innovation and application of blockchain technologies. Investors are beginning to acknowledge that other cryptocurrencies have established key roles in areas such as decentralized finance (DeFi), NFTs, and exchanges.

Spotlight on Prominent Altcoins: Aptos, Aave, and Lunex

This December, the crypto community focuses on leading contenders like Aptos (APT), Aave (AAVE), and the newly-launched Lunex (LNEX). Each of these assets signifies the increasing sophistication of altcoins, attracting investor interest as they exhibit promising upward trajectories.

Aptos stands out for its high throughput and exceptional scalability within the DeFi space, making it a staple among investors leery of older frameworks. Meanwhile, Aave has experienced a meteoric rise, boasting a staggering 120% increase just last month alone, driven by its robust lending ecosystem which places it among the most reliable assets for both new and returning investors.

Leading the charge in terms of innovation is Lunex Network, designed to simplify DeFi processes while promising high returns—up to 18% APY in staking rewards. Its concentrated focus on user convenience makes it an appealing option in the growing world of decentralized exchanges.

Charting the Future: Constructing a Digital Asset Portfolio

As investors start prioritizing diversified exposure to the crypto economy, constructing a portfolio that encapsulates the dynamism of the entire asset class is becoming increasingly vital. To capture long-term price appreciation and hedge against risk, portfolios that blend Bitcoin and selected altcoins are emerging as strategic choices.

With distinct sector characteristics and burgeoning unique use cases, leveraging the broader crypto ambiance will allow investors to maximize their potential gains while mitigating the inherent risks of market volatility.

Key Takeaways

- Market sentiment is shifting towards altcoins as key players amidst Bitcoin’s rise over $100K.

- Leading altcoins like Aptos, Aave, and Lunex are setting a new precedent for reliability and profitability in the digital asset space.

- Diversified portfolios encompassing both Bitcoin and select altcoins can enhance investor returns while minimizing risk.