Beyond Bitcoin: The Rise of Altcoin Season

Overview or Introduction

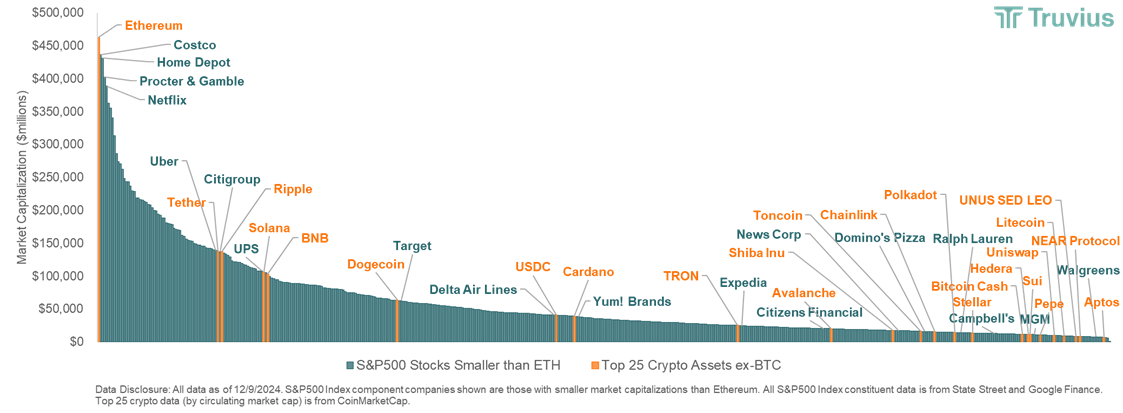

As the cryptocurrency landscape evolves, the idea of “altcoin season” has emerged as a pivotal moment for investors, signaling opportunities beyond the dominant Bitcoin. This article explores the current dynamics of altcoin season, the potential it offers, and why this shift in focus from Bitcoin to alternative cryptocurrencies is causing a stir in the market.

With indicators suggesting a robust altcoin season, it’s crucial for crypto investors to understand the implications for their portfolios and where to strategically put their money.

The Anatomy of Altcoin Season

Traditionally, cryptocurrencies have followed Bitcoin’s lead, making it the focal point for market predictions. However, altcoin season signifies a period when investors pivot their focus from Bitcoin to smaller, promising cryptocurrencies, or altcoins. This rotation allows lesser-known coins to potentially surge as investors seek higher returns from speculative assets.

The “Altcoin Season Index” serves as a barometer for this phenomenon, measuring the percentage of altcoins outperforming Bitcoin over a set period. Currently, the index is reflecting an altcoin season with 82 out of the top 100 cryptocurrencies outperforming Bitcoin, highlighting a shift in market momentum.

The Impact of Recent Political Developments

Since the U.S. presidential election in November, a significant wave of positive sentiment has hit the cryptocurrency market. Key appointments of pro-crypto figures, such as Paul Atkins as SEC chair and David Sacks as the incoming White House “AI and Crypto Czar,” indicate a regulatory environment that could favor altcoin growth. These developments have led to increased investor interest in altcoins, many of which are exhibiting exponential growth.

Prominent altcoins such as Hedera, Stellar, and Sui have seen gains of up to 481% as speculative investments drive enthusiasm during this altcoin season.

Constructing a Diverse Portfolio

Investors are encouraged to build diversified portfolios that encompass a range of cryptocurrency sectors. The importance of not limiting one’s investments solely to Bitcoin or well-established coins cannot be overstated. A broader exposure to the diverse digital asset class allows investors to capture potential returns from lower-market-cap assets that may have substantial growth potential.

Strategic allocation to promising altcoins within a diversified portfolio can mitigate risks associated with asset concentration and provide multiple return avenues, aligning with a long-term investment strategy.

Cautions and Next Steps

While the allure of altcoin season is undeniable, investors must approach with caution. Timing the market can be deceiving, as altcoin season can shift rapidly. Investors should focus on established altcoins with strong fundamentals rather than chasing speculative trends. Cryptocurrencies like Sui, with its recent attention from institutional investors, exemplify potential candidates for investment.

As we head into 2025, now is the opportune time for investors to identify and analyze less-trafficked altcoins that may offer significant upside as the market matures beyond just Bitcoin.

Key Takeaways

- Altcoin season indicates a market shift from Bitcoin to alternative cryptocurrencies, revealing investment opportunities.

- The recent political developments in the U.S. have positively influenced the crypto market and potentially bolstered altcoin growth.

- Diversifying investments into promising altcoins can enhance returns and mitigate risk.

- Timing the market can lead to missteps; focus should remain on long-term investment strategies rather than speculative trading.