Introduction

As the crypto markets face volatility, Bitcoin’s value hovers precariously close to a critical support zone. Risk assets are struggling, and with impending economic forecasts, investors are left questioning the stability of cryptocurrencies in the wake of shifting market sentiments.

Market Overview

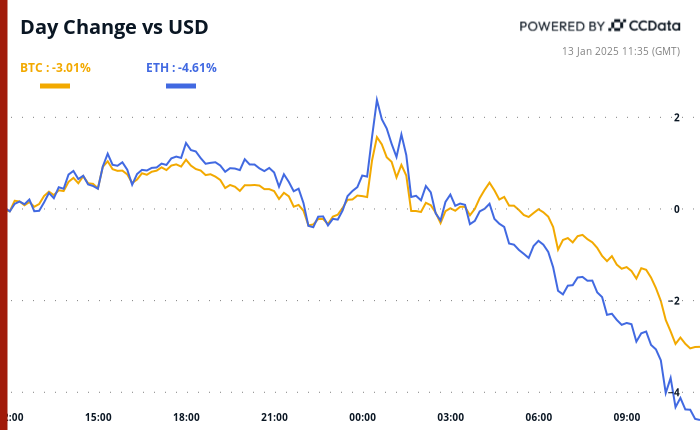

On January 13, 2025, Bitcoin (BTC) is down 2%, trading within a crucial support range of $90,000 to $93,000. This decline comes amidst a broader risk-off sentiment in financial markets, exacerbated by rising dollar strength and increasing Treasury yields. Ethereum (ETH) has also seen significant losses, marking its lowest price since late December 2024.

Investment Trends

Despite the negative market trends, interest from major investors remains. Michael Saylor points out MicroStrategy’s recent bitcoin acquisition of approximately $100 million, highlighting ongoing institutional demand. However, whether this will mitigate the prevailing negative sentiment is still up for debate. Major investment banks have signaled that a Fed rate-cutting cycle may be coming to an end, with Bank of America hinting at potential rate hikes, thereby increasing pressure on BTC prices.

Technical Indicators

The 30-day moving average of the Coinbase-Binance BTC price differential has slipped to its lowest since 2019, indicating weaker demand domestically. Analysts suggest a tough time ahead for Bitcoin as some expect prices could drop to $70K before a potential rally.

Upcoming Events and Market Focus

As the market braces for President-elect Donald Trump’s inauguration on January 20, attention shifts to key economic reports that could further influence crypto valuation. Additionally, the ongoing distributions related to FTX claims are likely to play a significant role in shaping market dynamics.

Key Takeaways

- Bitcoin is testing crucial support levels as it trades between $90,000 and $93,000.

- Interest from institutional investors remains despite a negative market trend.

- Upcoming economic reports and political events may significantly impact market sentiment and cryptocurrency values.

- Technical indicators show a concerning drop in demand, potentially signaling further price declines.