Bitcoin Soars Past $100K: The Return of the Crypto Bull Market

Overview or Introduction

The cryptocurrency market is buzzing with renewed energy as Bitcoin has once again crossed the significant $100,000 mark. This resurgence not only signals a bullish outlook for Bitcoin but also rejuvenates investor enthusiasm across altcoins like Ethereum, XRP, and Solana. In this article, we delve into the reasons behind Bitcoin’s dramatic rise, its implications for the cryptocurrency landscape, and what the future may hold for bitcoin and altcoin enthusiasts.

With inflation statistics aligning favorably for the crypto community and a potential Federal Reserve interest rate cut on the horizon, there’s substantial excitement around these digital assets. Join us as we dissect latest market trends, institutional involvement, and the growing regulatory landscape impacting this space.

Market Dynamics: Bitcoin’s Resurgence

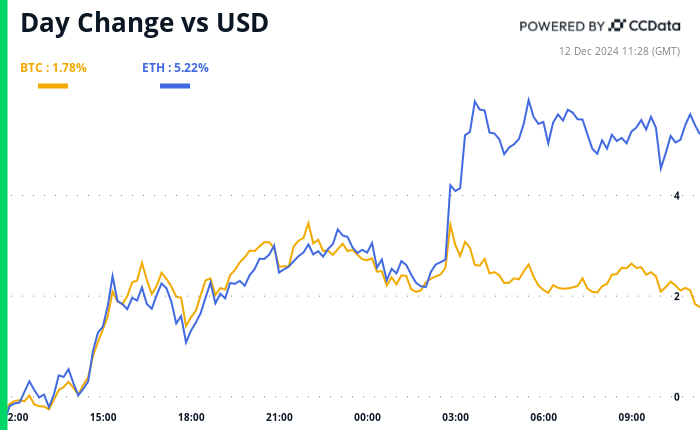

Bitcoin’s recent climb back above $100,000 has been propelled by forces beyond simply market speculation. Following a U.S. Consumer Price Index (CPI) report indicating inflation met expectations, investors have increasingly turned towards riskier assets, finding refuge in cryptocurrencies. The renewed purchasing activity led to Bitcoin trading as high as $100,500, marking a 5% increase in just 24 hours.

Notably, the market is buoyed by the prospect that the Federal Reserve may cut interest rates, as lower rates tend to trigger heightened risk appetite among investors. As this environment fosters optimism, Bitcoin’s return to a six-figure price bolsters the entire market, with notable activity observed in altcoins such as XRP, which soared by 17% to $2.44.

Altcoin Gains and Institutional Involvement

Bitcoin’s rally has reignited interest in altcoins; aside from XRP, other prominent players like Dogecoin and Solana are seeing robust increases. Dogecoin, favored by Elon Musk, is up nearly 9%, while Solana’s price increased by over 9% to $229.

Analysts cite increased institutional participation as a defining factor in this bullish cycle. For example, wallets linked to World Liberty Financial, backed by Donald Trump’s family, made significant acquisitions of AAVE and LINK tokens, driving their prices up by 30% in mere days. This interest from institutional players signals a maturing market and a shift toward broader acceptance of cryptocurrencies in mainstream finance.

Potential Challenges Ahead

Despite the bullish momentum, there are potential pitfalls to be wary of. A rise in inflation, if unexpectedly pronounced in further reports, could prompt a tighter monetary policy response, dampening investor sentiment. Furthermore, market analysts caution that the rapid growth of meme-based tokens and the overstretched supply in some areas of the altcoin market present challenges, particularly as demand-supply imbalances grow more pronounced.

Additionally, price evaluations guided by speculative trading can be volatile; hence, investors need to carefully assess their strategies in this unpredictable landscape. As questioned by experts, how sustainable is this bullish trend under potential macroeconomic pressures?

Key Takeaways

- Bitcoin has surged past $100,000, driven by favorable inflation data and increased institutional buying.

- Altcoins like XRP, Dogecoin, and Solana are also experiencing notable price increases, reflecting the renewed investor interest across the crypto market.

- Future inflation data and potential Federal Reserve policy shifts may impact the sustainability of this upward trend.