Introduction

In a pivotal shift for the cryptocurrency market, Bitcoin’s price has surged above $106,000. This remarkable spike comes alongside the implementation of new fair value accounting rules set by FASB, allowing U.S. companies to report their Bitcoin holdings at market value rather than purchase price. As corporate interest in cryptocurrency increases, the implications of this rule change could lead to a transformative wave of institutional investment.

FASB’s Fair Value Accounting Rule

The new FASB accounting rule, effective as of today, marks a significant change for U.S. companies holding Bitcoin. Previously, firms had to account for Bitcoin based on original purchase prices, which failed to capture the asset’s current valuation. This amendment allows corporations to reflect Bitcoin’s true market value, potentially increasing their balance sheets with the asset and accelerating broader adoption across various industries.

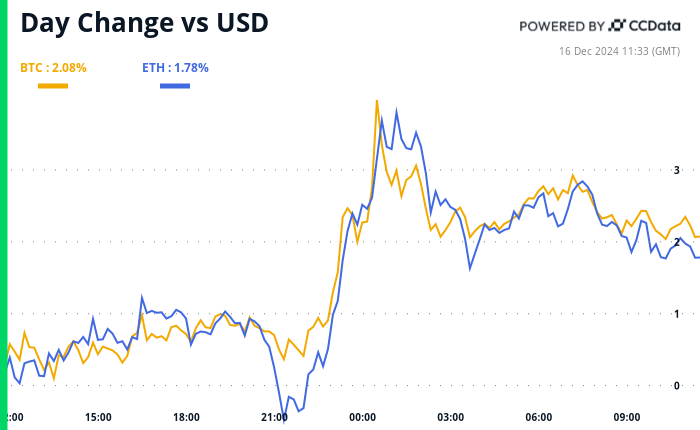

Market Reaction and Price Movement

Bitcoin’s response to the new accounting rule has been swift. Following the announcement, Bitcoin rose to a peak of $106,000 in Asian markets, partially fueled by President-elect Donald Trump’s promises regarding a strategic Bitcoin reserve. However, the price retraced to around $104,500 as investors balanced excitement over the rule change against caution about an upcoming Federal Reserve interest rate announcement that may tighten financial conditions further.

Other Cryptocurrency Trends

While Bitcoin reached new heights, Ethereum struggled to maintain a foothold above $4,000, facing large withdrawals from staking protocols. Meanwhile, Solana’s revenue generation continues to attract attention, reportedly surpassing all other Layer 1 networks combined in fees, although it experienced a slight dip in token value.

What Lies Ahead

As Bitcoin nears its next potential threshold of $120,000, traders remain optimistic about a ‘Santa Claus Rally,’ supported by both institutional interest and seasonal patterns. However, the market must remain vigilant, particularly with economic indicators like the U.S. Treasury yields and pending macroeconomic data releases that could shift market sentiment significantly.

Key Takeaways

- Bitcoin surpasses $106,000 following the implementation of FASB’s fair value accounting rule.

- The new accounting rule allows companies to hold Bitcoin at market value, encouraging greater adoption.

- Concerns linger regarding upcoming Federal Reserve interest rate movements and their impact on market dynamics.