Introduction

As Bitcoin’s price hovers just above the critical $100,000 mark, the cryptocurrency market grapples with a unique blend of optimism and apprehension. A pivotal shareholder vote by MicroStrategy and recent geopolitical developments are setting the stage for potentially volatile market movements. This article delves into the latest updates, market indicators, and key events shaping the future of cryptocurrencies.

Market Stability Amidst Shifting Political Landscape

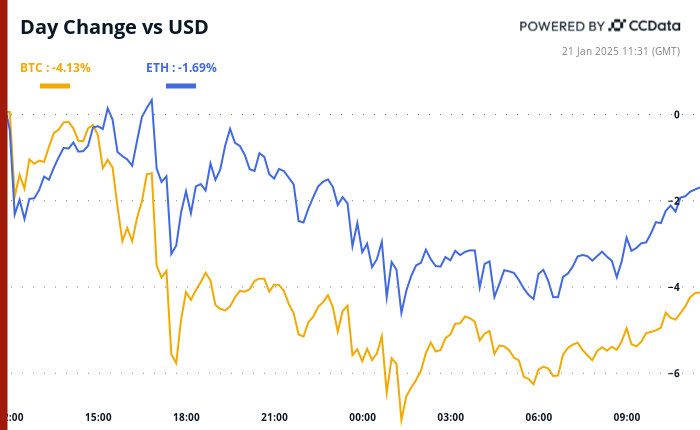

In the wake of President Trump’s inauguration, Bitcoin has impressively maintained its status above $101K despite the President’s lack of mention of cryptocurrencies in his speech. Analysts note that this resilience comes amidst signals of increased price volatility and a growing risk aversion among traders. Griffin Ardern from BloFin highlights this tension, as geopolitical factors—including the looming tariff proposals on Canada and Mexico—threaten to shake market stability.

MicroStrategy’s Strategic Vote

One significant event to watch is MicroStrategy’s upcoming shareholder vote aimed at increasing its authorized share capital. This move is crucial as it is directly tied to the firm’s strategy to bolster its Bitcoin holdings. Market speculations are rife about how this decision could influence Bitcoin’s price in the immediate future.

The Impact of Monetary Policies

Adding complexity to the market, the Bank of Japan’s anticipated interest rate increase may also create ripples across global markets, including cryptocurrencies. Historically, such rate hikes have destabilized risk assets, signifying that traders should prepare for potential volatility impacting their investment strategies.

Emerging Trends and New Players

Amidst these uncertainty-driven dynamics, the launch of the TRUMP memecoin has emerged as a noteworthy phenomenon, drawing significant attention and capital into the cryptocurrency space. This event not only highlights the evolving digital asset landscape but suggests a dual narrative of market rotation and new investment influxes that could signal a shift towards greater acceptance of cryptocurrencies.

The Road Ahead

Looking forward, several critical dates loom on the horizon: MicroStrategy’s shareholder vote, upcoming SEC decisions on ETF proposals, and significant token events. These events will play a vital role in shaping cryptocurrency valuations and investor sentiment as the market navigates the intersection of regulatory scrutiny and innovative developments in the crypto sphere.

Key Takeaways

- Bitcoin remains stable above $100K despite market volatility.

- MicroStrategy’s strategic shareholder vote is pivotal for its Bitcoin buying framework.

- Geopolitical events and monetary policies may influence market dynamics significantly.

- The debut of memecoins reflects growing investor interest and market diversification.