Bitcoin’s Volatile Dance: Innovation, Investment, and Federal Influence

Overview or Introduction

In the ever-shifting landscape of cryptocurrency, few forces exert as much influence as major market players and federal policy shifts. The recent surge in Bitcoin purchases by MicroStrategy juxtaposed with sharp declines in Bitcoin’s price following Federal Reserve statements underscores this volatility. As investors watch closely, understanding these dynamics is crucial for grasping the future of cryptocurrency.

This report dives into the latest developments surrounding Bitcoin and other key cryptocurrencies, explaining what these trends mean for investors, the market, and the broader financial system.

MicroStrategy’s Significant Bitcoin Acquisition

MicroStrategy, a notable player in the Bitcoin investment sphere, has made headlines once again by acquiring an additional 15,350 BTC, bringing its holdings to a staggering total of 439,000 BTC. The purchase, finalized on December 15, amounts to approximately $1.5 billion, translating to an average purchase price of $100,386 per bitcoin. This bold move emphasizes the company’s ongoing strategy to leverage Bitcoin as a core asset.

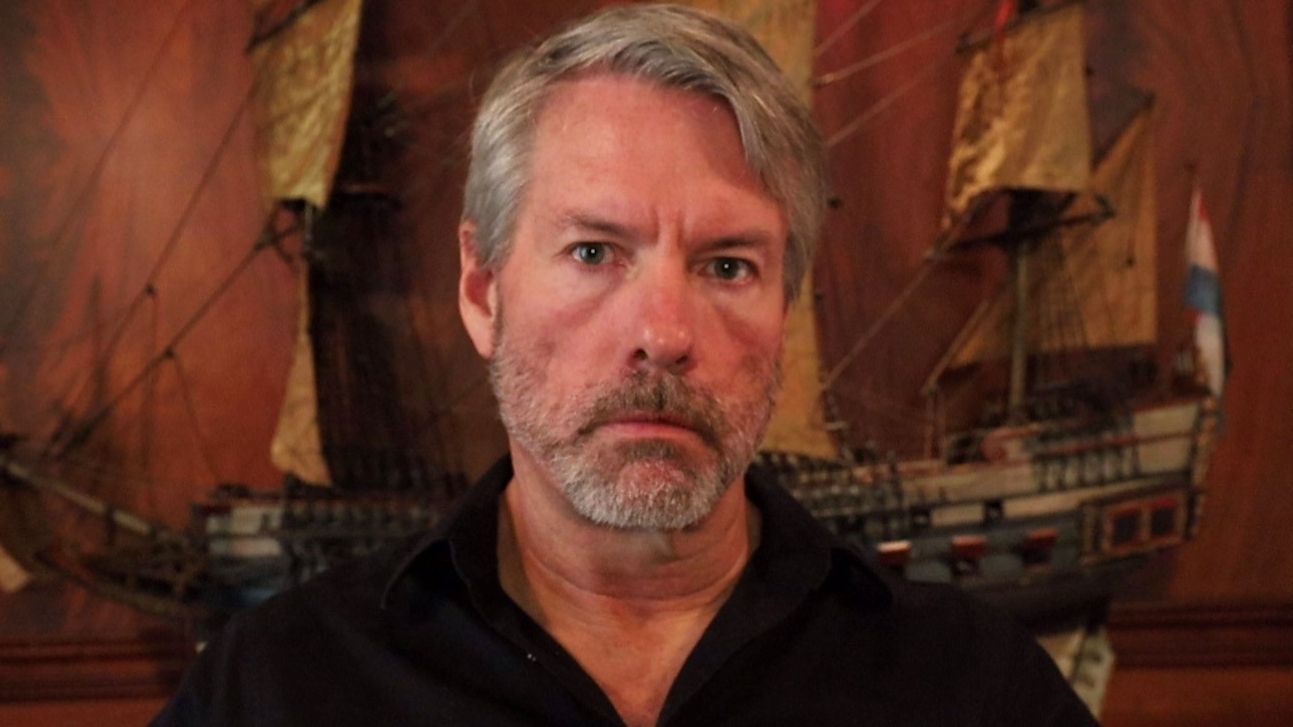

This acquisition was funded through a portion of MicroStrategy’s available funds raised from share sales under its at-the-market (ATM) program. Michael Saylor, the company’s Executive Chairman, has cultivated a public image as a Bitcoin evangelist, frequently teasing announcements about significant purchases before U.S. market openings.

As it stands, MicroStrategy has established itself as a pioneer among institutional investors, particularly following its entry into the Nasdaq 100. With this recent development and anticipated regulation changes from the Financial Accounting Standards Board (FASB) concerning digital asset accounting, the stage is set for broader corporate engagement in Bitcoin investments.

Market Reactions and Federal Reserve Policies

In stark contrast to the bullish sentiment surrounding MicroStrategy’s acquisitions, Bitcoin and other leading cryptocurrencies faced considerable bearish pressure following comments from Federal Reserve Chair Jerome Powell. The Fed’s decision to cut interest rates by 25 basis points, coupled with indications of a cautious approach to future cuts, triggered fears among investors. Bitcoin plummeted nearly 5% after recently hitting an all-time high of over $108,000.

Such fluctuations unveil an undeniable relationship between cryptocurrency and traditional financial instruments. The response from traders has been notable, with over $690 million in future positions liquidated within a 24-hour period, revealing the high-stakes environment in which cryptocurrency investors operate. Major assets like XRP and Dogecoin saw declines of 10% and 9%, respectively, as traders reeled from the shifting economic policies.

Key Takeaways

- MicroStrategy’s aggressive Bitcoin acquisitions underscore institutional enthusiasm for cryptocurrency.

- Federal Reserve policies continue to significantly influence cryptocurrency markets, as seen with the sudden price drop after recent rate cuts.

- Changes in regulations regarding digital asset accounting by the FASB may propel more corporate investments in cryptocurrencies.

- The volatile nature of cryptocurrencies presents both opportunities and significant risks for investors and traders alike.