Bitcoin’s Volatility: MicroStrategy’s Big Bet Amid Fed Rate Cuts

Overview or Introduction

The world of cryptocurrency is once again at a crossroads, with transformative moves from major players like MicroStrategy unfolding alongside unpredictable market shifts driven by the Federal Reserve. This article examines the implications of MicroStrategy’s recent Bitcoin purchase as well as the impact of the Fed’s rate cut decision on cryptocurrency prices. Readers will find insights into market trends and what these developments mean for the future of Bitcoin and beyond.

MicroStrategy’s Strategic Expansion

MicroStrategy, the corporate pioneer in Bitcoin investments, has made headlines by acquiring an additional 15,350 BTC, raising its total holdings to a staggering 439,000 BTC—a stake valued at around $45.6 billion. Following this move, the company’s stock surged, a sign of confidence that resonates in the digital asset space. The shares were acquired at an average price of $100,386 per coin and funded through its at-the-market (ATM) program, reflecting a strategic push amidst the backdrop of their inclusion in the Nasdaq 100, effective December 23.

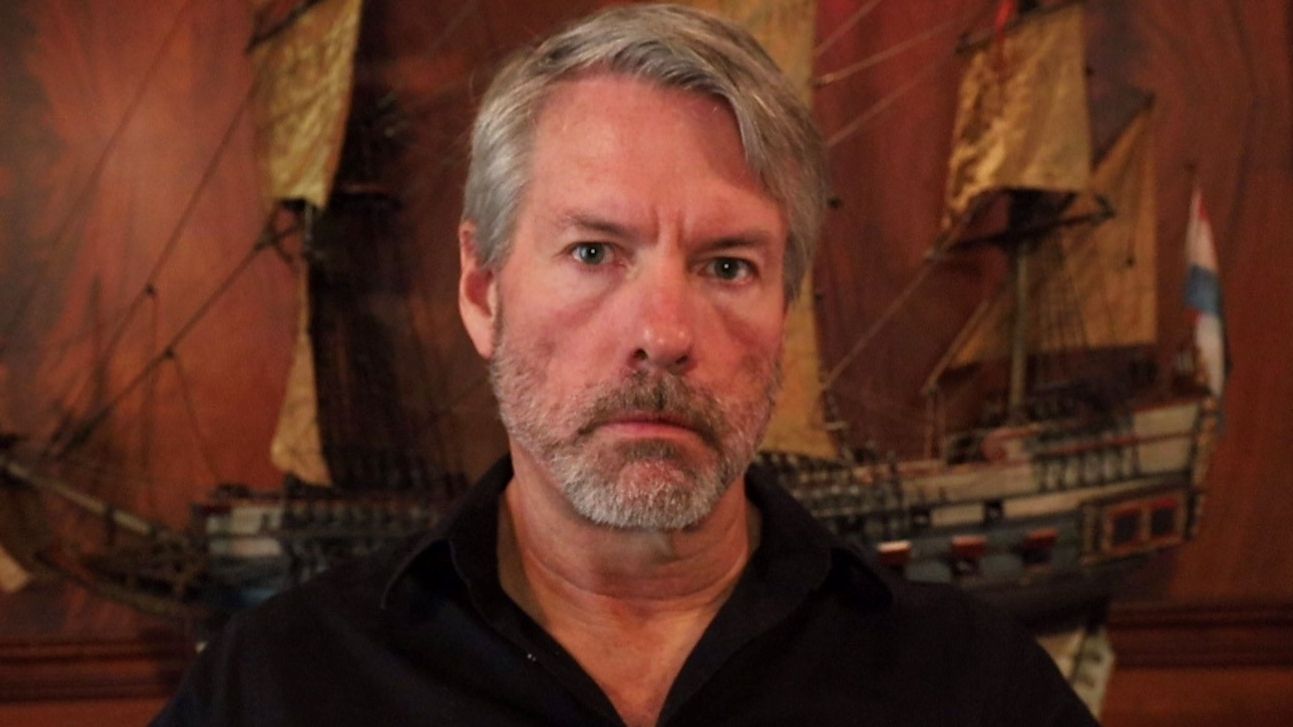

CEO Michael Saylor strategically hinted at this acquisition on social media days before the announcement, unveiling a trend where MicroStrategy frequently reveals Bitcoin purchases ahead of major US market openings. Such actions have not only solidified MicroStrategy’s role as a leader in institutional Bitcoin uptake but have also energized retail and institutional investors alike.

Federal Reserve’s Rate Cuts and Their Aftermath

In a contrasting narrative, Bitcoin and other major cryptocurrencies such as XRP and Dogecoin saw sharp declines following a recent announcement from Federal Reserve Chair Jerome Powell regarding a cut in interest rates. While a 25-basis point cut was implemented, market reactions suggested investors were losing faith in risk assets, prompting fast sell-offs across the cryptocurrency board. Bitcoin plummeted nearly 5% within 24 hours, after reaching an all-time high above $108,000 earlier in the week, illustrating the volatile nature of crypto amidst economic uncertainties.

This volatility has been further accentuated by the increasing liquidations in futures trading, with over $690 million in long positions wiped out in just a day. Analysts are now calling attention to the potential for the Fed’s cautious stance on future rate adjustments to sway market sentiment away from cryptocurrencies designed to hedge against inflation, a preserved view from 2022.

The Intersection of Corporate Strategy and Market Movement

The juxtaposition between MicroStrategy’s aggressive Bitcoin acquisition strategy and the Federal Reserve’s potential to dampen market optimism highlights the complexity of investing in digital currencies. While MicroStrategy positions Bitcoin as a cornerstone of its treasury management, the larger market remains affected by external monetary policy decisions, emphasizing the challenge of navigating volatility in the realm of cryptocurrencies.

Key Takeaways

- MicroStrategy’s Bitcoin holdings ballooned to 439,000 BTC, valued at about $45.6 billion following a $1.5 billion purchase.

- The company’s strategic ATM program funding reveals a calculated bet on Bitcoin amidst market uncertainties.

- Following the Fed’s rate cut announcement, Bitcoin and other cryptocurrencies faced significant downward pressure, showcasing the fragility of this market.

- Liquidations in cryptocurrency futures reached over $690 million, signaling traders’ apprehensions in the current economic climate.