Introduction

As we embark on a new year, the crypto landscape is buzzing with anticipation and reminiscent of previous market cycles. With Bitcoin making notable gains and traditional macroeconomic factors intertwining with digital asset dynamics, 2025 is poised to be a pivotal year for cryptocurrencies.

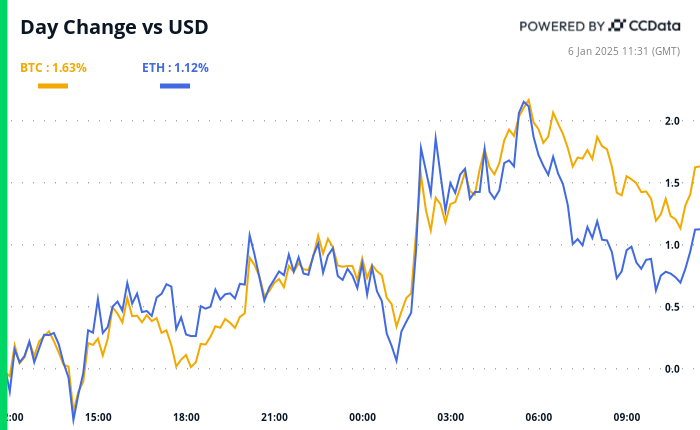

Bitcoin’s Resurgence

Bitcoin has shown a remarkable recovery trend, with an 8% increase since late December. Analysts at JPMorgan emphasize ongoing market forces fueling Bitcoin’s rise, linking its price performance to investor behavior amid inflationary concerns. The intertwining fate of Bitcoin and gold has led to a significant shift in asset allocation strategies aimed at hedging against currency debasement.

Macro Economic Influences

Despite Bitcoin’s upbeat trajectory, market participants remain cautious due to rising bond yields and a strengthening dollar, which may cap potential gains in the short term. Key economic indicators, including upcoming nonfarm payroll reports, are set to challenge the prevailing narratives surrounding Federal Reserve policies and economic optimism.

Market Dynamics: ETH and MicroStrategy

Ether’s price is being subjected to pressures from increased liquidity in decentralized finance platforms, notably Ethena. Amidst this backdrop, prominent companies like MicroStrategy are redistributing their crypto holdings, demonstrating the complex interplay of tech and finance as market strategies evolve. Meanwhile, the broader altcoin space is showing signs of volatility with rising interest in tokens like SOLV.

Upcoming Events to Watch

Several significant events are lined up to shape the crypto landscape in early January, including major token launches and upgrades on popular decentralized exchanges. Stakeholders are urged to stay updated on market movements that could drive dramatic price shifts across the board.

Key Takeaways

- Bitcoin’s recent 8% recovery signals strong market conviction amid ongoing inflation concerns.

- Upcoming economic reports will be crucial in assessing future price movements and market stability.

- Investors are increasingly treating Bitcoin and gold as complementary assets in their portfolios.

- Rising dynamics within DeFi are influencing Ether prices, potentially limiting short-term upside.