Introduction

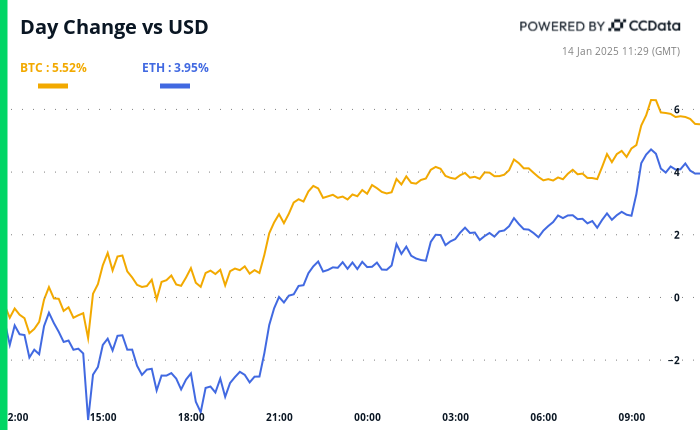

The cryptocurrency market faces considerable volatility, with Bitcoin’s price plunging below $90,000 before rebounding to $96,000. Yet, this decline hasn’t deterred institutional interest, as corporations increasingly seek to adopt Bitcoin amid these turbulent conditions.

Market Overview

As of January 14, 2025, Bitcoin (BTC) remains a focus for institutional investors, illustrated by reports of large purchases such as Intesa Sanpaolo’s acquisition of 11 BTC for $1 million. Even during price dips, significant corporate Treasury purchases have continued, suggesting a robust demand for Bitcoin as a hedge against inflation and economic instability.

Institutional Adoption and Economic Factors

Despite bearish sentiments and macroeconomic challenges illustrated by rising Treasury yields and Fed rate expectations, institutional appetite for Bitcoin persists. Research indicates that corporations have acquired over 5,700 BTC within the first two weeks of January, accelerating a trend that could strengthen Bitcoin’s position in the market.

Price Recovery and Future Predictions

After hitting a low of $90,000, BTC’s swift recovery to over $96,000 raises hopes among bulls of an imminent rally into six figures. The upcoming U.S. producer price index data will be pivotal in shaping market expectations—softer inflation figures could alleviate pressures on the Federal Reserve and further energize the crypto market.

What to Watch

As the market evolves, several crypto developments are on the horizon, including upgrades and releases from various projects. Observing these events will be critical for predicting future price movements and investment strategies.

Key Takeaways

- Bitcoin’s price volatility contrasts with growing institutional adoption.

- Major banks and corporations continue to invest in Bitcoin amid market uncertainty.

- Upcoming economic data may impact Bitcoin’s trajectory in the coming weeks.