Introduction

The cryptocurrency market is experiencing significant turbulence with over $300 billion wiped out since the beginning of the year. Bitcoin (BTC) finds itself precariously holding above $93,000 amidst a backdrop of global economic challenges and intense scrutiny of market conditions.

Market Overview

As of January 6, the total cryptocurrency market capitalization has fallen below $3.2 trillion, triggering concerns about the sustainability of price levels. The unconfirmed reports regarding the U.S. government’s potential liquidation of 69,370 BTC from the Silk Road seizure compound the bearish sentiment. President-elect Donald Trump’s commitment not to sell any of the government-held Bitcoin adds a layer of political complexity to the situation.

Global Economic Pressures

The current turmoil is fueled by high levels of the DXY index, indicating a strong U.S. dollar, alongside fluctuating treasury yields impacting investor sentiment. Observations from LondonCryptoClub indicate that rising inflation and growth expectations are pushing U.S. yields upward, which in turn exerts pressure on global yields, excluding China.

U.K. Financial Pressure

Across the Atlantic, the U.K. faces its challenges as soaring gilt yields reach record highs. The government is under strain following a problematic budget, significantly increasing borrowing needs without showing positive growth outcomes. This has led to further detraction of the pound against the dollar, now at its lowest level since November 2023.

Impending Economic Reports

With the U.S. stock market closed on January 9 for a day of mourning, attention turns to the forthcoming jobs report. Analysts warn that stronger-than-expected job numbers could stall anticipated rate cuts, highlighting the market’s current “good news is bad news” dilemma.

Upcoming Events

Important dates loom on the economic calendar, including significant employment and inflation reports that could dictate forthcoming monetary policy and market sentiment. Investors are on high alert, ready to react to potential shifts in market dynamics.

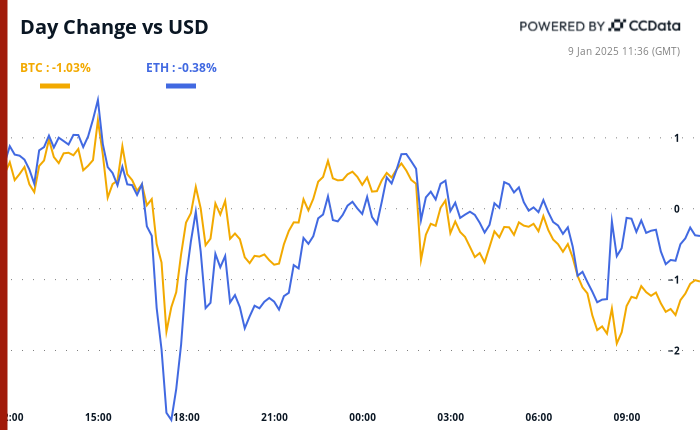

Market Movements

In the present trading climate, Bitcoin is down slightly by 1.24% over the last 24 hours, now priced at $93,307.05. Meanwhile, Ethereum has seen a slight uptick, illustrating the mixed sentiments pervasive in the market.

Key Takeaways

- Over $300 billion has been swept from the cryptocurrency market due to rising inflation and interest rates.

- The U.S. government may liquidate substantial Bitcoin holdings, adding to market volatility.

- Global economic conditions, including U.K. fiscal pressures, amplify concerns in the crypto landscape.

- Upcoming economic data is critical for future market movements, particularly regarding interest rates.