Introduction

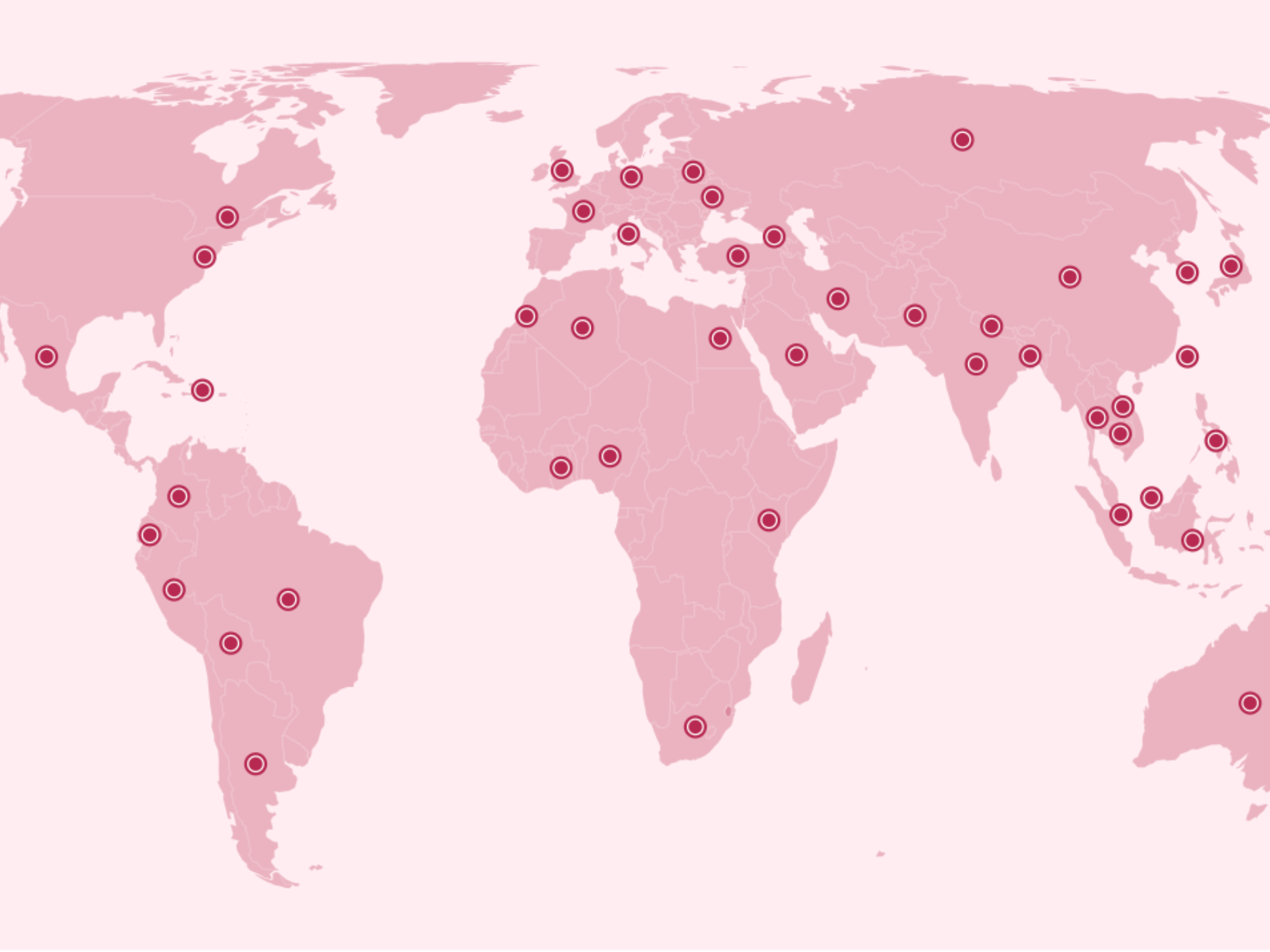

As the landscape of cryptocurrency continues to evolve, so too does the framework of regulations governing its use. From the United States to Europe and Asia, governments are scrambling to catch up with the rapid growth of this sector, aiming to protect consumers while fostering innovation. This article delves into the latest developments in cryptocurrency regulation worldwide, exploring how different nations are addressing this transformative financial phenomenon.

The U.S. Regulatory Landscape

Amidst ongoing tensions in the cryptocurrency market, the U.S. has made strides towards establishing a regulatory framework since 2022. The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have been tasked with imposing rules on crypto operations. Although several significant rulings have favored the crypto industry, the SEC remains vigilant, as highlighted by recent legal battles involving major exchanges like Ripple and Coinbase.

European Union’s Comprehensive Regulations

In a landmark move, the EU introduced the Markets in Crypto-Assets Regulation (MiCA) in May 2023, establishing the first comprehensive framework for cryptocurrencies in the world. This regulation emphasizes consumer protection and mandates licenses for all service providers engaged in crypto operations. The EU continues to consult the public on several measures to enhance crypto governance and prevent illicit activities linked to digital assets.

Asia: Diverse Approaches

Regulatory standards in Asia vary significantly. Japan embraces cryptocurrencies as legal property and has tightened regulations on exchanges to combat money laundering. In contrast, China maintains a stringent ban on cryptocurrency trading and mining, reflecting its cautious approach. South Korea is advancing its regulatory framework with user protection laws, while India remains uncertain, sitting on the fence regarding the legalization of digital currencies.

Latin America’s Evolving Regulations

Brazil has recently passed the Cryptoassets Act, positioning its central bank as the supervisory body for cryptocurrency, aimed primarily at combating fraud. This regulatory move highlights the growing acceptance of crypto as a payment method in Brazil. Other countries in the region are also seeking to establish regulations that support the safe use of cryptocurrencies.

Key Takeaways

- The U.S. and EU are leading in establishing extensive crypto regulations, focusing on consumer protection and industry oversight.

- Asia exhibits a range of regulatory approaches, from acceptance in Japan to strict bans in China.

- Latin American countries like Brazil are enhancing their regulatory frameworks to facilitate the safe use of cryptocurrencies.

- Global cooperation and consistent regulations are crucial to manage the cross-border nature and risks involved in cryptocurrency activities.