Introduction

In the early months of 2025, a dynamic clash unfolds between the world of U.S. equities and the ever-evolving realm of cryptocurrency. Bitcoin, bolstered by bullish forecasts, aims to break through the $100,000 barrier. Meanwhile, the S&P 500 hints at a potential risk-off environment, triggered by geopolitical uncertainties as Donald Trump prepares for his inauguration.

Current Market Dynamics

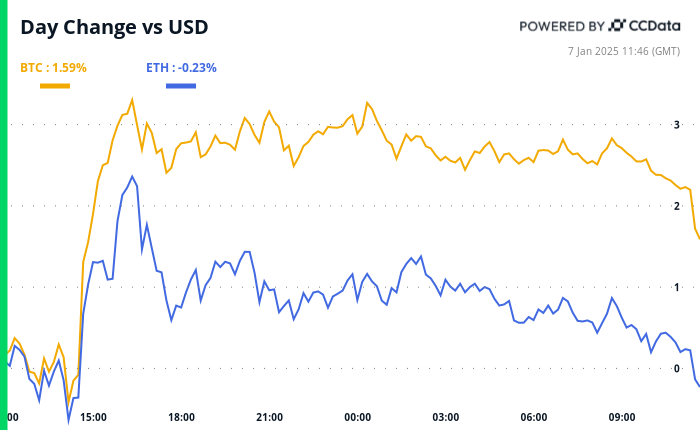

Bitcoin’s recent rally showcases a marked divergence from traditional stock indices. With projections placing Bitcoin above $100,000, optimism pervades the cryptocurrency market, driven in part by anticipated economic reforms under Trump. Conversely, the S&P 500 options now reflect heightened downside risks, signaling investor wariness amidst profit-taking and potential changes in market sentiment.

Investor Sentiment and Market Signals

Financial analysts express concern about a “sell-the-news” scenario following Trump’s inauguration, suggesting that recent exuberance in the markets might lead to a corrective phase. The recent spike in Bitcoin prices, accompanied by an inflow of liquidity, contrasts sharply with the tentative stance of equity investors, whose fear indicators now loom larger.

Spotlight on Bitcoin’s Resilience

Despite external pressures, several factors may bolster Bitcoin’s position. Observations indicate miners are reluctant to sell their assets, driven by positive net unrealized profit metrics, which reflect an ongoing preference to hold onto BTC. This underlines Bitcoin’s potential to decouple from traditional market behaviors as liquidity recovers and regulatory clarity appears on the horizon.

Global Economic Indicators

Simultaneously, rising bond yields internationally present a challenging backdrop for risk assets. With Japanese and British bond yields spanning their highest levels in decades, the broader market may reassess its risk exposure. Traders are advised to remain vigilant as these shifts in monetary policy and fiscal sentiment could affect everything from Bitcoin’s performance to traditional equities.

Key Takeaways

- Bitcoin is approaching the $100,000 mark, driven by bullish sentiment and liquidity influx.

- The S&P 500 indicates greater risk aversion amidst geopolitical and economic uncertainty.

- Market analysts caution against possible profit-taking following Trump’s inauguration.

- International bond markets reflect rising yields, posing challenges for risk assets.

- Miners show a preference for holding Bitcoin, indicating a potential strong position in the cryptocurrency market.