From Altcoins to Asset Class: The Evolution of Cryptocurrency

Overview or Introduction

The cryptocurrency landscape is undergoing a profound transformation, evolving from a binary classification of Bitcoin and “altcoins” to a sophisticated and diverse asset class. As the market rebounds following a series of regulatory victories and electoral shifts, investors are reexamining how they categorize and invest in digital currencies. This piece explores the upcoming altcoin season and its implications for the crypto market, providing insights into opportunities for savvy investors willing to adapt to changing dynamics.

This transition away from labeling altcoins as mere alternatives to Bitcoin recognizes their significant value and growing market influence. With altcoins poised for potential breakthroughs in 2025, understanding this transformative period is essential for investors seeking both stability and growth.

The Landscape of Altcoins

In the aftermath of the latest U.S. election, the cryptocurrency environment has shifted favorably, as indicated by the surge of Bitcoin to unprecedented price levels. This bullish trend is drawing attention to lesser-known cryptocurrencies that are increasingly making their mark on the market. Traditionally, market analysts have divided cryptocurrencies into two categories: Bitcoin and altcoins. However, as the industry matures and diversifies, this oversimplified view is becoming outdated.

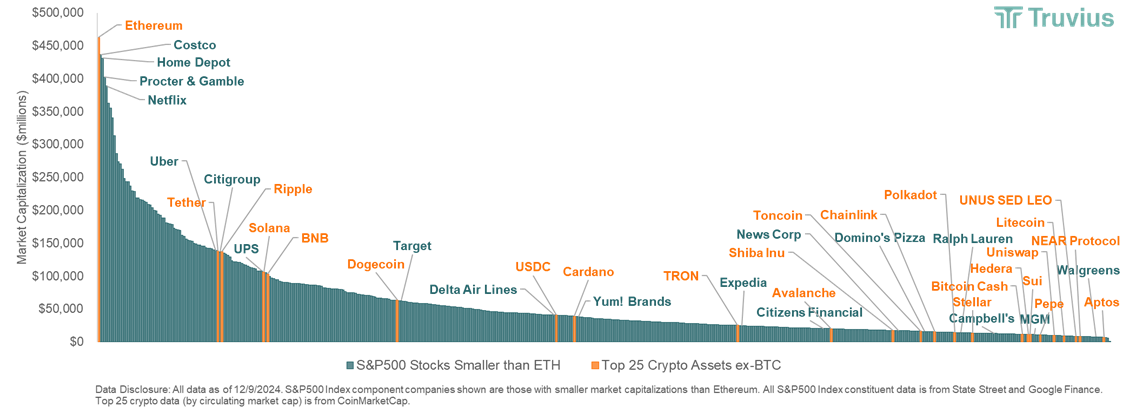

Recent analyses show that many of the top 25 altcoins have market capitalizations comparable to leading companies within the S&P 500. This blurring of lines suggests that altcoins are not merely secondary players but formidable contenders within the broader digital asset ecosystem.

What is Altcoin Season?

Altcoin season refers to periods when altcoins outperform Bitcoin, leading investors to shift their focus from Bitcoin to a wider array of cryptocurrencies. Currently, several indicators confirm the arrival of altcoin season, heralding increased volatility and opportunity in this segment of the market.

As reported by multiple sources, the Altcoin Season Index recently surged, indicating that a significant number of top cryptocurrencies are outperforming Bitcoin over a 90-day period. This index serves as a litmus test for the broader market sentiment, highlighting the shifting tides that can lead to substantial gains for astute investors.

Strategizing Investments in the New Asset Class

With altcoins gaining traction, investors are urged to adopt a more nuanced approach. Diversification across various crypto assets could mitigate risks associated with concentration and maximize potential returns. As the sector continues to grow and innovate, it is crucial for investors to remain adaptable, dynamically adjusting their portfolios to capitalize on emerging trends and opportunities.

While investing in promising altcoins, investors should remain wary of speculative bets and focus on established assets with solid fundamentals. Among the current frontrunners are Hedera (up 481%), Stellar (up 415%), and Sui (up 383%). These altcoins’ growth trajectories underscore the potential for investors willing to take calculated risks in a diversified portfolio.

Conclusion: Embracing the Future of Cryptocurrency

As the cryptocurrency market actively evolves, it is crucial for investors to rethink their strategies. The term “altcoin” may soon become a relic of the past, replaced by recognition of the diversity and potential within the digital asset class. By embracing this shift and focusing on long-term value, investors can position themselves to benefit from the forthcoming developments in this intriguing asset landscape.

Key Takeaways

- The cryptocurrency market is transitioning from binary classifications to a diverse asset class.

- Recent market shifts have confirmed the arrival of altcoin season, with many altcoins significantly outperforming Bitcoin.

- Investors are encouraged to diversify their portfolios and avoid speculative investments, focusing on assets with solid fundamentals.

- Understanding and adapting to evolving market dynamics is essential for maximizing returns in the cryptocurrency space.