Introduction

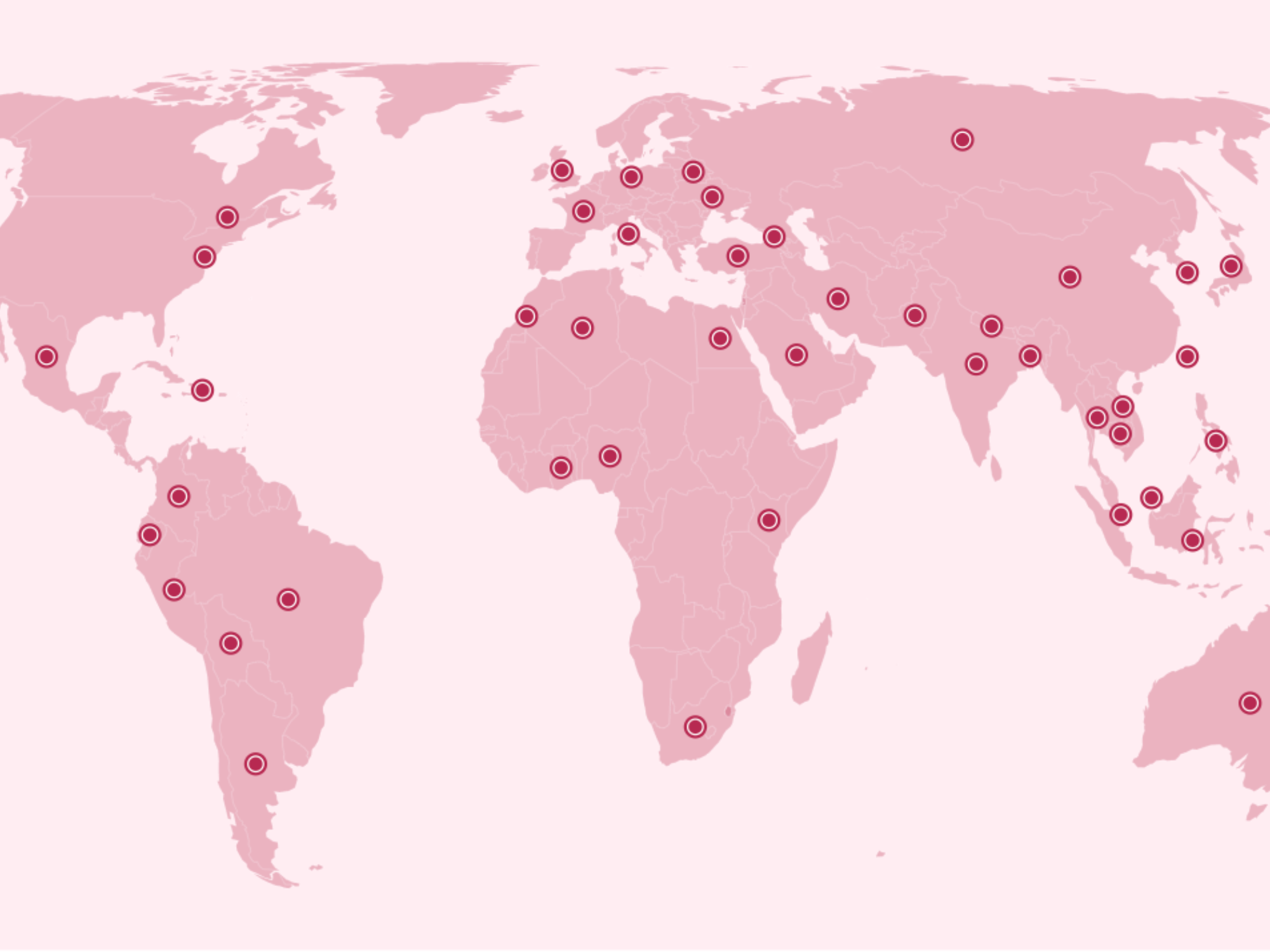

The rise of cryptocurrencies has sparked a global regulatory renaissance, as governments scramble to define rules that foster innovation while protecting consumers. With the market maturing, regulators are focusing on creating comprehensive frameworks that can handle the complexities of digital assets.

The United States: A Work in Progress

The United States has made strides toward a more robust regulatory environment since announcing its first comprehensive framework in 2022. However, legal battles involving major players like Ripple and Coinbase reveal the ongoing challenges. Significant court rulings, including the approval of Bitcoin and Ethereum Spot ETFs, suggest a conflicted approach, with SEC Chair Gary Gensler signaling that much remains unsettled in defining the status of various cryptocurrencies.

Europe’s Leading Edge

In May 2023, the European Union established the Markets in Crypto-Assets Regulation (MiCA), heralding a new age of clarity and consumer protection across member states. This innovative legislation aims to create licensing requirements for service providers, ensuring that investor interests are safeguarded against malfeasance in the aftermath of high-profile collapses like FTX.

Asia: Divergent Paths

Asian countries show contrasting regulatory perspectives, with Japan and South Korea leading progressive initiatives to protect users while facilitating crypto use. Japan recognizes cryptocurrencies as legal property, while South Korea has implemented the Virtual Asset Users Protection Act to enhance user safeguards. Conversely, China’s stringent bans on crypto-related activities underscore an opposing attitude that prioritizes strict control over innovation.

Latin America and Beyond

Brazil has embraced cryptocurrencies by establishing a regulatory framework to curb scams and provide oversight via its Central Bank. Meanwhile, India continues to stall legislative efforts to clarify its stance on digital currencies, oscillating between the introduction of a regulatory bill and recognizing cryptocurrencies as property for tax purposes. The global regulatory environment remains fragmented, as various nations grapple with the implications of digital assets.

Key Takeaways

- Regulatory approaches to cryptocurrency are evolving worldwide, reflecting varying attitudes toward innovation and consumer protection.

- The U.S. continues to face legal complexities while establishing its regulatory framework, highlighted by conflicting court decisions.

- The EU’s MiCA regulations set a precedent for comprehensive oversight, while countries like Japan and South Korea adopt progressive stances.

- Latin America is experiencing shifts in crypto regulation, with Brazil leading the charge in creating structured guidelines.