MicroStrategy’s Bold Bitcoin Strategy: Analyzing Market Moves and Legal Shifts

Overview or Introduction

As Bitcoin continues its tumultuous rise and fall, few companies have committed to the cryptocurrency like MicroStrategy. Recent developments including substantial investments and favorable legal changes have positioned MicroStrategy as a key player in the Bitcoin market. This article delves into the company’s latest moves and the broader implications of recent court rulings affecting cryptocurrency exchanges like Coinbase.

The unfolding narrative surrounding Bitcoin not only reflects the volatility of the market but also highlights how regulatory landscapes are evolving to accommodate this digital asset revolution. MicroStrategy’s investments and Coinbase’s legal victories offer crucial insights for both investors and tech enthusiasts alike.

MicroStrategy’s Massive Bitcoin Purchase

On December 15, 2024, MicroStrategy added 15,350 BTC to its already robust holdings, bringing its total Bitcoin portfolio to a staggering 439,000 BTC worth approximately $45.6 billion at current market prices. This significant purchase was completed for an average price of $100,386 per Bitcoin, funded through their existing public share offerings. MicroStrategy’s strategy of accumulating Bitcoin has reaped the attention of the market, especially with recent news of its impending inclusion in the Nasdaq 100.

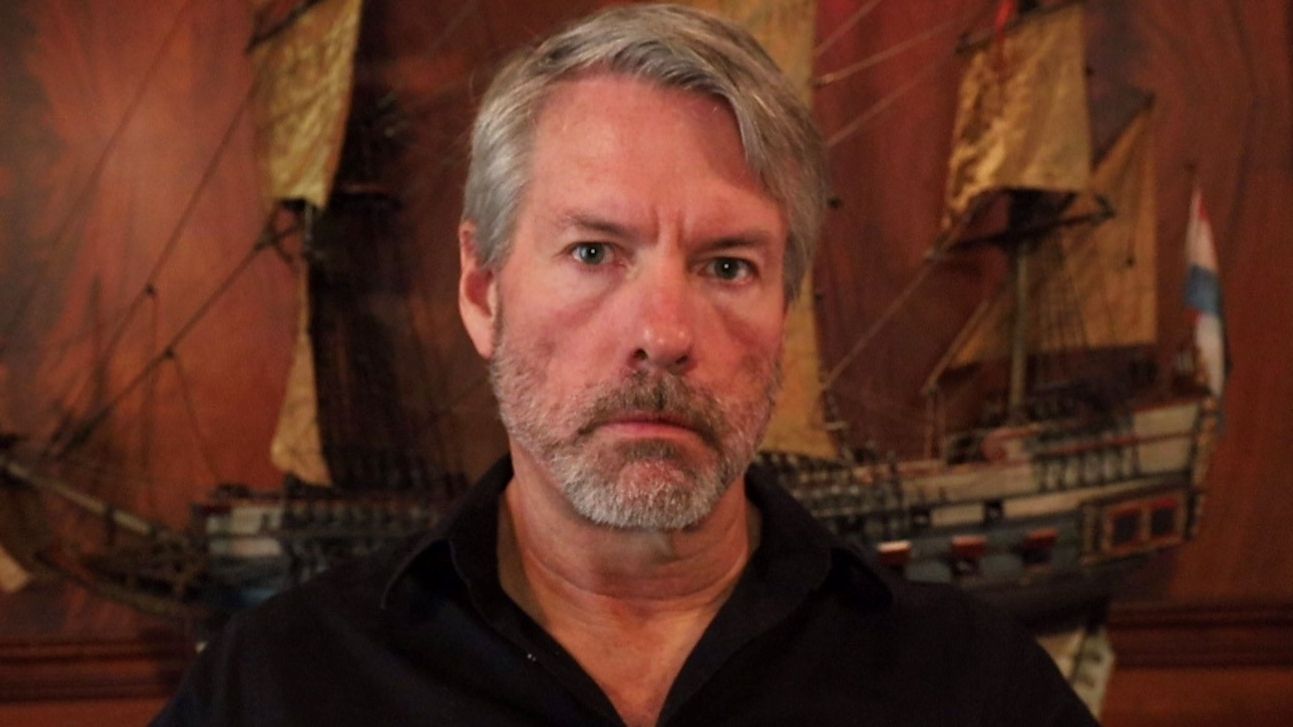

Michael Saylor, Executive Chairman of MicroStrategy, has maintained a trend of announcing acquisitions on Mondays ahead of market opens. The latest transaction fits within the company’s “21/21 plan,” which aims to enhance their Bitcoin position. Upon the news of their Nasdaq inclusion, MicroStrategy’s stock rose 4% pre-market, showcasing the immediate financial impact of this corporate maneuver.

Legal and Regulatory Changes Impacting the Crypto Market

In parallel to MicroStrategy’s aggressive Bitcoin acquisition, the crypto landscape has seen significant legal developments. A federal judge ruled in favor of Coinbase, allowing the exchange to proceed with the delisting of Wrapped Bitcoin (WBTC). This decision was prompted by BiT Global’s request for a temporary restraining order, which was denied due to insufficient evidence of imminent harm. The ruling mitigated concerns previously raised regarding potential control of WBTC falling into the hands of Justin Sun, founder of Tron. Such regulatory movements signal a shift towards more structured oversight of cryptocurrency exchanges.

This development highlights the delicate balance exchanges must maintain between operational autonomy and regulatory compliance as cryptocurrencies gain legitimacy in the eyes of regulators and investors. For Coinbase, this ruling not only safeguards its business model but also reaffirms its commitment to long-term stability in a rapidly evolving market.

Key Takeaways

- MicroStrategy has increased its Bitcoin holdings to 439,000 BTC, solidifying its position as a major player in the market.

- The recent purchase underscores a broader trend within institutional investors toward embracing Bitcoin amid rising prices.

- Legal developments, such as the court ruling favoring Coinbase, illustrate shifting regulatory landscapes critical to the functioning of cryptocurrency markets.

- Companies like MicroStrategy are reshaping investment strategies and highlight the importance of adaptation within the financial sector.