Overview or Introduction

MicroStrategy, a major player in the cryptocurrency landscape, has dramatically expanded its bitcoin holdings after a significant inclusion in the Nasdaq 100 index. As the company moves further into the digital asset sphere, understanding the implications of its actions helps investors navigate the evolving crypto market. This article delves into MicroStrategy’s recent purchase, its motivations, and the broader impact on the cryptocurrency ecosystem.

As bitcoin hovers near record highs, MicroStrategy’s strategic acquisitions signal not just a bullish outlook on cryptocurrencies but also highlight a pivotal moment for institutional investment in digital assets.

MicroStrategy’s Latest Acquisition

On December 15, MicroStrategy finalized a purchase of 15,350 BTC for an impressive total of $1.5 billion, raising its overall bitcoin holdings to a staggering 439,000 BTC. This purchase was made at an average cost of $100,386 per coin, which greatly contrasts with the company’s overall average acquisition price of $61,725 per bitcoin. The latest round of acquisitions has been facilitated through shares sold in an ongoing at-the-market (ATM) offering program, leaving the firm with about $7.65 billion in availability.

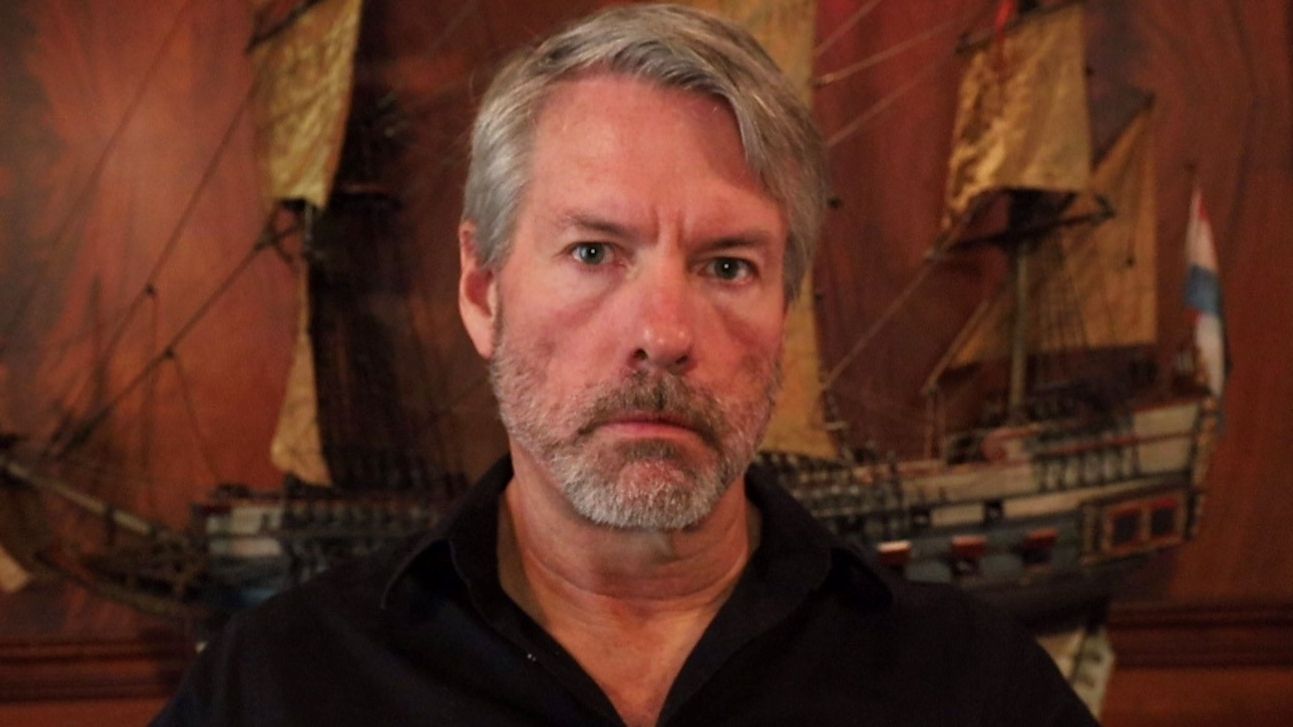

Executive Chairman Michael Saylor has built a reputation for publicly announcing significant purchases on Mondays—a trend that has seemingly become a routine. Over the past few weeks alone, MicroStrategy purchased around 171,430 BTC for an estimated $15.61 billion, continuing what has been dubbed the “21/21 plan.”

The Impact of Nasdaq 100 Inclusion and Accounting Changes

MicroStrategy’s inclusion in the Nasdaq 100 index, effective December 23, has further bolstered investor confidence, as evidenced by a 4% rise in its pre-market trading shares to $425. In light of this inclusion, the Financial Accounting Standards Board (FASB) recently implemented new fair value accounting measures for digital assets, allowing firms to reflect both gains and losses in their net income. Previously, companies could only acknowledge impairments, potentially stifling the valid recognition of asset appreciation in such volatile markets.

With bitcoin surpassing $104,000 recently, MicroStrategy’s bold moves indicate a long-term commitment to digital assets, setting a remarkable precedent for other corporate investors.

Market Reactions and Future Outlook

The ripple effects of MicroStrategy’s decisions extend beyond its balance sheet, impacting multinational finance and investment strategies. Arthur Hayes, former CEO of BitMEX, has voiced concerns regarding the broader outlook for bitcoin amidst political transitions, suggesting potential sell-off scenarios tied to anticipated lukewarm engagements from government institutions. Investor confidence in cryptocurrencies may hinge on how effectively these changes are communicated and executed in the coming months.

As MicroStrategy continues its aggressive acquisition strategy in a landscape marked by volatility, the firm’s actions will undoubtedly be closely monitored by industry players and investors alike.

Key Takeaways

- MicroStrategy’s recent $1.5 billion bitcoin purchase raises its holdings to 439,000 BTC, emphasizing its commitment to digital assets.

- New Nasdaq 100 inclusion and accounting measures could positively influence the perception of corporate involvement in cryptocurrencies.

- The ongoing bitcoin price surge underscores a potential shift in institutional investment dynamics within the cryptocurrency market.

- Comments from industry leaders like Arthur Hayes highlight the uncertainty surrounding political impacts on bitcoin investments.