Introduction

As cryptocurrency transcends its initial conception as a speculative investment to a legitimate asset class, nations worldwide are racing to establish regulations. With the rapid evolution of digital currencies, the challenges and opportunities for regulation are pivotal to shaping the future of finance.

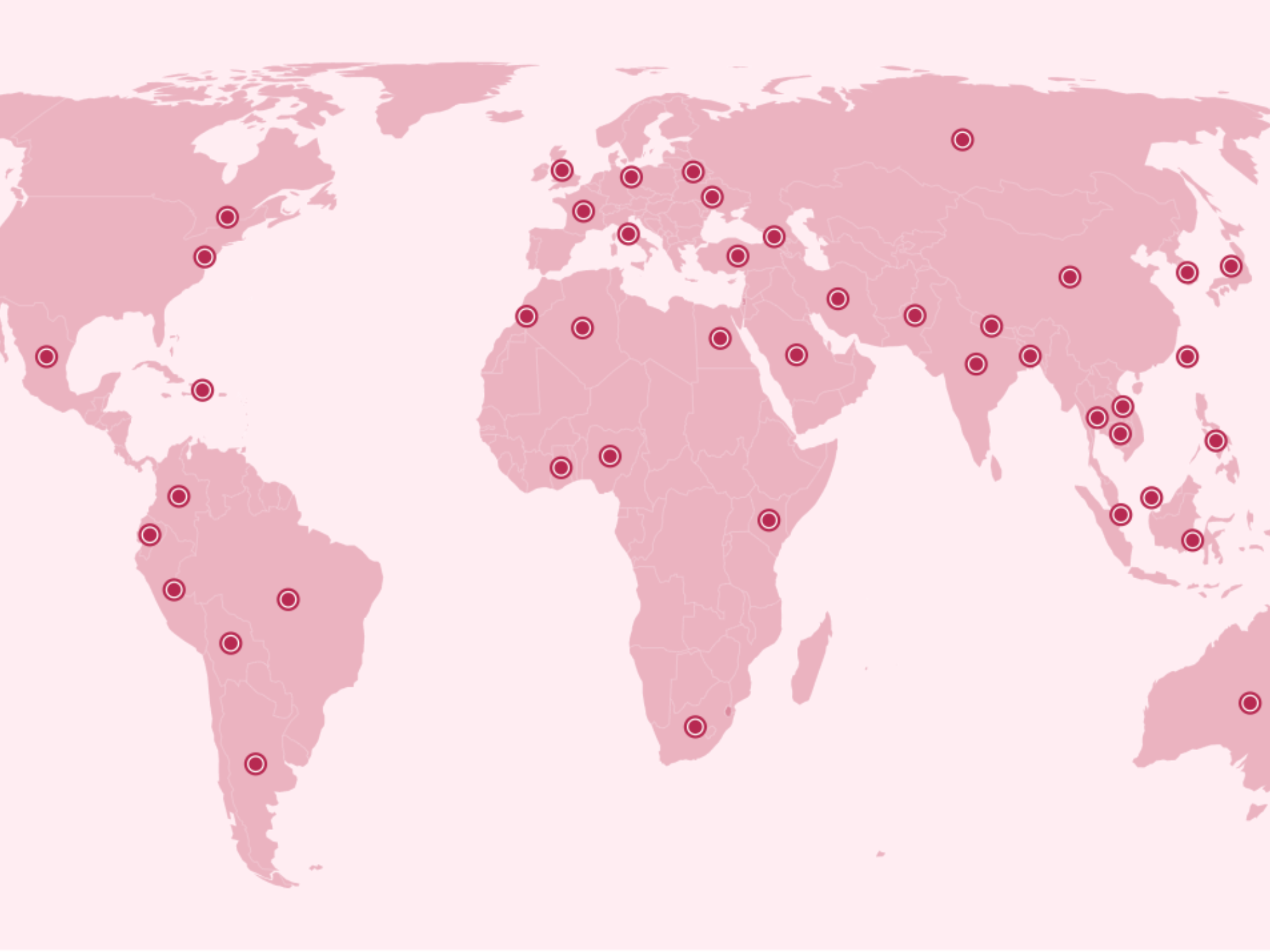

Global Regulatory Landscape

Governments from the United States to the European Union and beyond are crafting frameworks designed to both encourage innovation and protect consumers. The International Organization of Securities Commissions has proposed 18 key recommendations aimed at fostering regulatory consistency across countries. These developments come in response to growing concerns over fraud and financial instability linked to digital assets.

US Framework Developments

In the US, regulatory discourse has intensified with the introduction of frameworks granting authority to the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Recent court rulings highlighted a developing legal landscape, paving the way for the first Bitcoin and Ethereum Spot ETFs, reflecting a cautious yet progressive approach to regulation.

European Union Initiatives

The EU’s Markets in Crypto-Assets Regulation (MiCA) represents a groundbreaking effort to unify cryptocurrency oversight. Beginning in 2023, these regulations require all service providers to be licensed and enhance transparency around transactions, with particular attention to anti-money laundering efforts.

Asia’s Diverse Regulatory Approaches

In Asia, approaches to cryptocurrency regulation vary dramatically. While Japan embraces crypto as a recognized form of property, China enforces stringent bans on trading and mining. Countries like South Korea and India are tentatively advancing their regulatory frameworks, reflecting the complexities of balancing innovation with potential risks.

Emerging Regulations in Latin America

Brazil’s recent integration of cryptocurrency regulations under the central bank aims to combat scams and establish robust user protections. This growing regulatory focus mirrors trends seen in the US and EU, emphasizing a global movement toward formalizing the crypto sector.

Conclusion: The Path Forward

As global regulators grapple with the implications of cryptocurrencies, the challenge remains to strike a balance between fostering innovation and safeguarding financial systems. Future regulations are likely to evolve as lessons are learned from past missteps and emerging market dynamics.

Key Takeaways

- Countries worldwide are developing cryptocurrency regulations aimed at protecting consumers and preventing fraud.

- The US has begun implementing frameworks but continues to experience legal challenges in its regulatory approach.

- European regulations through MiCA are set to standardize oversight and improve transparency in the crypto market.

- Asia displays a mix of regulatory strategies, from Japan’s acceptance to China’s outright bans.

- Brazil’s recent regulatory changes highlight a growing global consensus towards establishing legal frameworks for cryptocurrency.