Introduction

As India’s economic growth projections wane, financial analysts are adjusting their strategies to navigate the turbulent waters. UBS’s latest insights shed light on the implications of a weakening rupee and its effects on the investment landscape.

The Current Economic Landscape

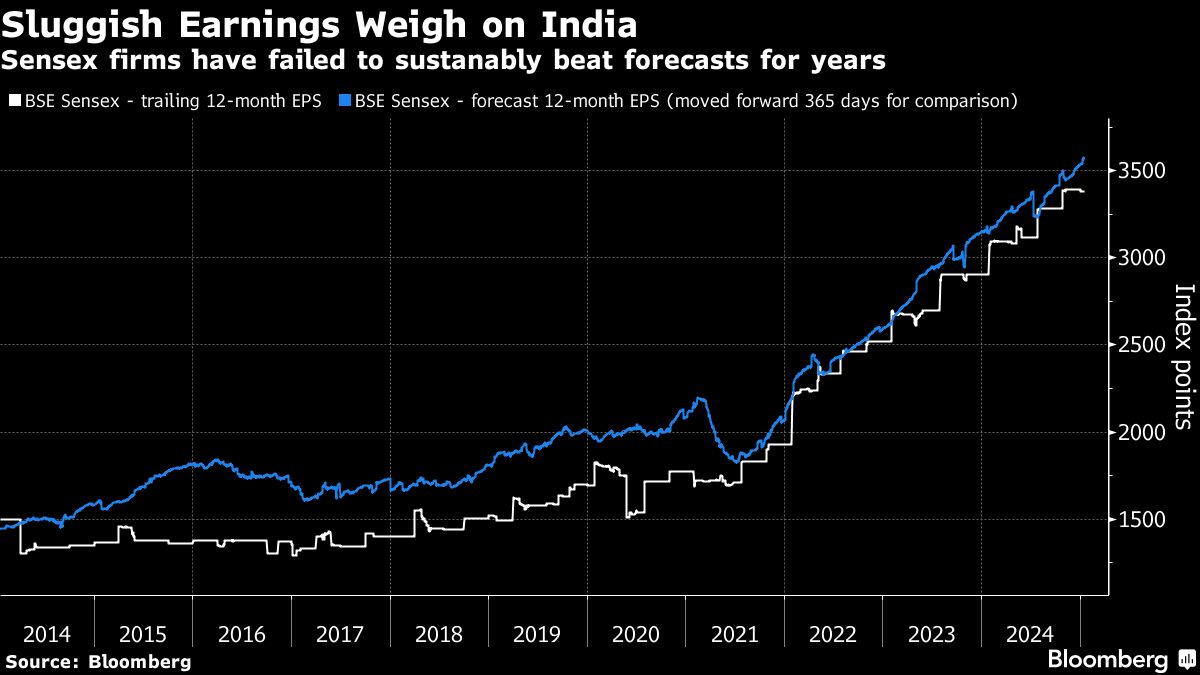

Recent reports indicate a noticeable slowdown in India’s economic growth. Analysts at UBS are raising concerns about the sustainability of previous growth forecasts, which have led to a cautious outlook among investors. The rupee has been particularly vulnerable, adjusting downward in response to these changed expectations.

UBS’s Strategic Outlook

In light of the recent economic shifts, UBS is advocating for a ‘shorting’ strategy on the rupee. This approach underscores a belief that the currency may continue to weaken, prompting financial stakeholders to reassess their positions in the Indian market. With inflation pressures and external economic factors at play, the suggestion comes as a strategic move to mitigate potential losses.

Market Reactions

The financial markets are responding to these developments; trading patterns indicate a rising interest in alternative investments as traders look to hedge against currency volatility. The sentiment among market participants is one of caution, provoking a reevaluation of risk management practices in the face of a shifting economic paradigm.

Key Takeaways

- India’s economic growth is showing signs of slowdown, prompting reevaluation from UBS.

- UBS suggests a ‘shorting’ strategy on the Indian rupee amid concerns of continuing weakness.

- Market reactions indicate a pivot towards alternative investments as traders seek to navigate currency volatility.