Introduction

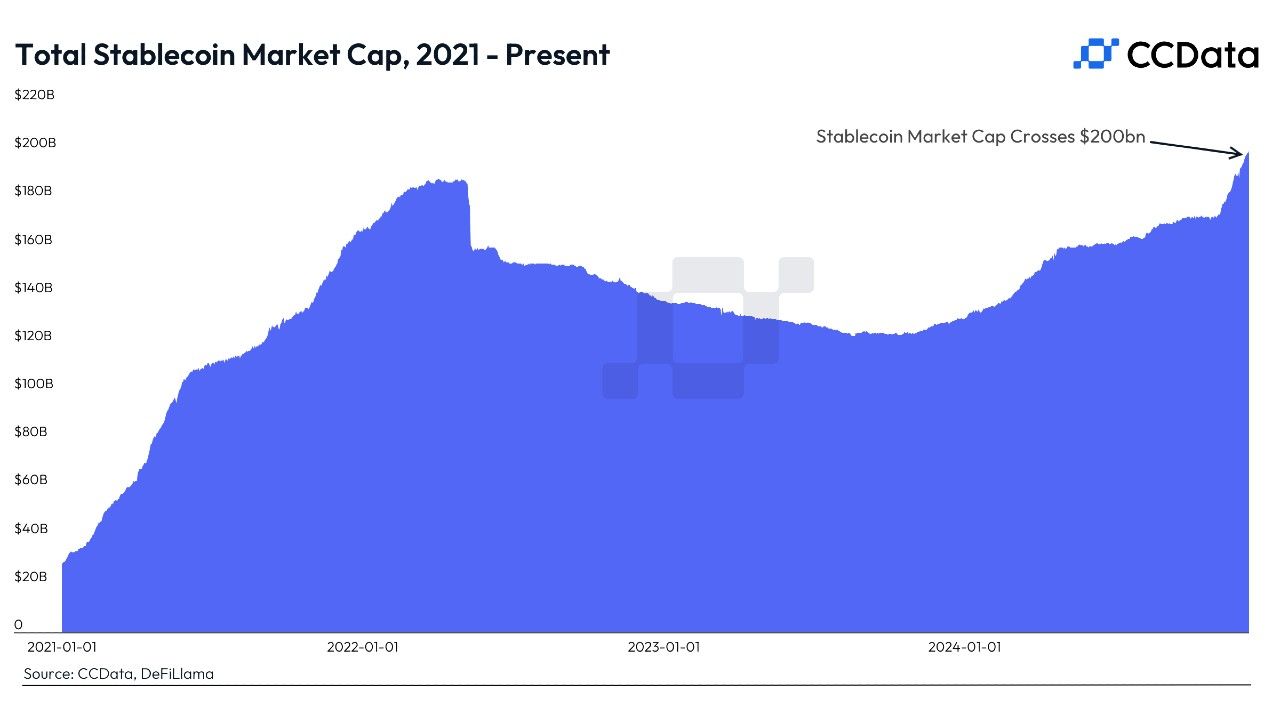

In a landmark moment for the cryptocurrency landscape, the stablecoin market surpassed a total market capitalization of $200 billion, a first in its history. This growth underscores an accelerating adoption and demand for these digital assets as they become increasingly integrated into both the crypto and traditional financial systems.

The Surge in Market Value

Recent data from CCData and DefiLlama reports that the stablecoin market added $10 billion in value in just two weeks after surpassing the 2022 bull cycle benchmark of $190 billion. Stablecoins, primarily pegged to the U.S. dollar, now play a critical role in the cryptocurrency infrastructure by providing essential liquidity for trading and facilitating value transfer across blockchain networks.

Drivers of Growth

The past year has seen a steady increase in stablecoin demand, significantly buoyed by the resurgence of crypto markets following an extended bear cycle. The recent political landscape, notably Donald Trump’s recent electoral victory, has sparked heightened investor interest, adding approximately $30 billion in new stablecoin supply. Tether’s USDT leads the charge, reaching a supply peak of $139 billion, while Circle’s USDC has also seen remarkable growth, nearing $41 billion.

Utilization Beyond Trading

Stablecoins are not merely tools for trading. Their adoption for payments, remittances, and savings is rising, particularly in regions grappling with unstable local currencies. Transaction volume on peer-to-peer payment platforms demonstrates a growing acceptance of stablecoins in everyday financial activities. Additionally, innovative offerings such as Ethena’s yield-generating USDe token highlight the demand for stablecoins capable of providing earnings.

The Future of Stablecoins

Projections suggest that the stablecoin market could double in size to approximately $400 billion by 2025. Factors contributing to this growth include potential regulatory clarity from the U.S. Congress and the increasing integration of stablecoins into mainstream fintech applications. This new regulatory framework may encourage traditional financial institutions, including major banks, to participate in the stablecoin ecosystem, further legitimizing the asset class.

Key Takeaways

- The stablecoin market cap surpassed $200 billion, signifying robust growth.

- USDT and USDC are the dominant stablecoins, with rising supplies.

- Stablecoins are increasingly used for payments and savings in developing nations.

- Predictions indicate the market could reach $400 billion by 2025.

- Regulatory clarity may stimulate interest from traditional financial institutions.