The Bitcoin Rollercoaster: MicroStrategy’s Bold Moves and Market Reactions

Overview or Introduction

The world of cryptocurrency is no stranger to volatility and surprising decisions. Recently, MicroStrategy made headlines by significantly increasing its Bitcoin holdings amidst market fluctuations triggered by the Federal Reserve’s latest actions. This dual narrative of bullish corporate moves and bearish market reactions not only reflects the tumultuous nature of cryptocurrencies but also poses critical questions about the future of digital assets.

As investment strategies evolve and central bank policies shift, understanding these dynamics is crucial for investors and enthusiasts alike. This report delves into MicroStrategy’s substantial investments in Bitcoin and the immediate effects of economic indicators on the broader crypto market.

MicroStrategy’s Increasing Bitcoin Portfolio

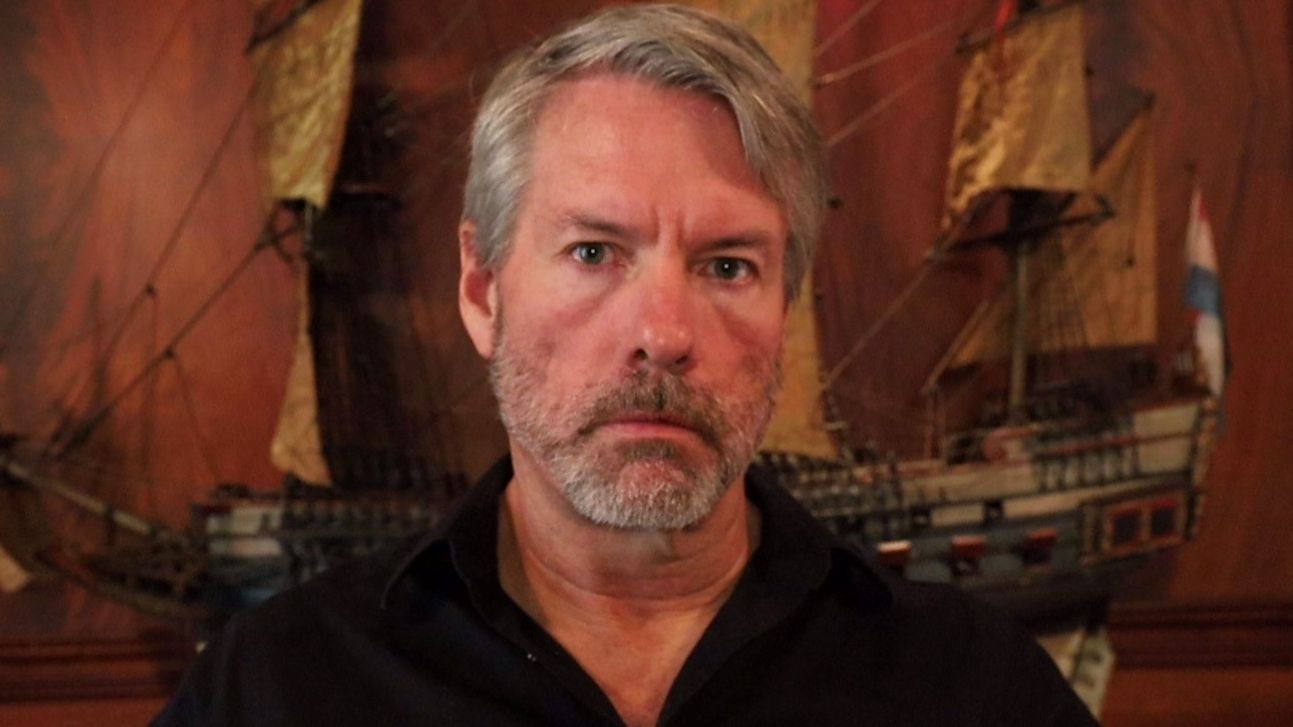

In a bold stroke that underscores its commitment to cryptocurrency, MicroStrategy has announced the acquisition of an additional 15,350 BTC, raising its total holdings to approximately 439,000 BTC. This latest purchase, completed on December 15, represents an investment of $1.5 billion, with an average acquisition price of nearly $100,386 per Bitcoin.

The timing of this purchase aligns with MicroStrategy’s recent inclusion in the Nasdaq 100 index, a move that may add to its visibility and credibility in the financial marketplace. The company has funded this acquisition through its at-the-market (ATM) program, leaving it with roughly $7.65 billion available for further investments.

These moves come amidst a broader trend where MicroStrategy has consistently announced Bitcoin purchases on Mondays, signaling a strategic approach to capitalize on investor activity. The company’s share priced rose by 4% following the news and at the time of the announcement, Bitcoin was trading at over $104,000, just shy of its all-time high.

Market Reactions to Federal Reserve Decisions

Conversely, the cryptocurrency market faced a significant downturn following recent announcements from Federal Reserve Chair Jerome Powell. After a surprise statement regarding a potential interest rate cut, Bitcoin and other major cryptocurrencies like XRP and Dogecoin experienced sharp declines. Bitcoin plummeted nearly 5% to a price of $101,430 after achieving a new peak above $108,000 earlier in the week.

The decline is reflective of a shifting investor sentiment as the Fed indicated that it would exercise caution in future monetary policy adjustments. This moment of caution has left traders liquidating positions, resulting in over $690 million in futures being closed in just 24 hours. Most of these were long positions following the Fed’s announcements, showing how sensitive cryptocurrency trading is to traditional financial news.

Key Takeaways

- MicroStrategy’s recent purchase boosts its Bitcoin holdings to 439,000 BTC, reflecting a strong bullish stance amidst market fluctuations.

- The company’s strategy of announcing purchases before market openings indicates a tactical approach to maximize impact.

- The cryptocurrency market is heavily influenced by broader economic indicators, as evidenced by the sharp declines following the Fed’s interest rate update.

- Investor liquidations reached over $690 million due to rapid market shifts following less-than-aggressive policy outlooks from the Fed.