The Dawn of a New Era: Transforming Altcoins into an Asset Class

Overview or Introduction

The cryptocurrency landscape is evolving at an unprecedented pace. As Bitcoin exceeds the $100,000 mark and regulatory hurdles diminish, the conversation around altcoins is shifting. Investors are questioning the traditional binary classification of Bitcoin and alternative coins. This report delves into the emerging narrative surrounding altcoins, highlights promising projects, and proposes how investors can seize opportunities within this growing asset class.

In an era marked by rapid innovation, understanding the complexities of the digital asset ecosystem has never been more crucial. It’s not just about Bitcoin anymore. Let’s explore how altcoins are redefining the market.

Redefining Altcoins: More Than Just Alternatives

In recent years, the term “altcoin” has often been used dismissively to categorize all cryptocurrencies other than Bitcoin. However, the vast landscape of digital assets, which now surpasses mere alternatives, must be approached with a more nuanced perspective. Following the U.S. presidential election and key appointments like Paul Atkins as SEC chair and David Sacks as a crypto advocate, the regulatory sentiment has become favorable, amplifying investor confidence in altcoins.

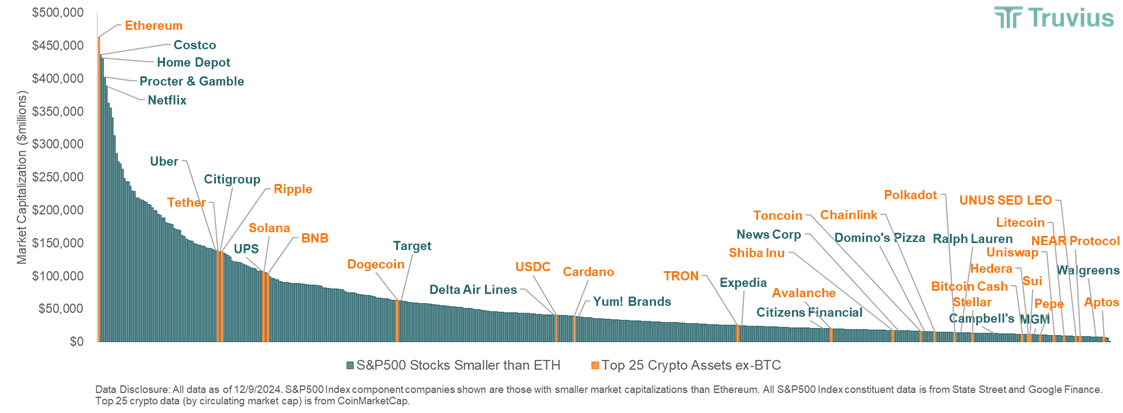

This rapid evolution presents typecasting as a major risk; current market dynamics indicate a burgeoning multi-sector asset class that includes distinct ecosystems, each with unique use cases and growth potential. For instance, prominent players such as Solana and Aave are not just alternatives but fast-rising stars with significant market cap and functional applications that mirror established industries.

The Altcoin Surge: A Look into December 2024’s Rising Stars

The upcoming months are crucial as optimism spreads through the market with Bitcoin’s record-breaking surge. Among the touted altcoins, Aptos, Aave, and Lunex are capturing headlines for their impressive performances. Lunex, in particular, has thrived during its presale, boasting a staggering 283% price gain, driven by innovative features that simplify decentralized finance (DeFi).

Aave, a key player in the lending protocol sector, has witnessed a remarkable 120% increase in value in November. Its market cap now exceeds $5.3 billion, showcasing the growing demand for reliable lending and borrowing services in the crypto realm. Aptos also adds to the mix, representing a solid investment option known for its reliability.

Structuring a Diverse Portfolio in the Digital Asset Space

To harness the full potential of this shifting landscape, investors must evolve their strategies from a simple “Bitcoin vs. altcoins” approach to creating a well-rounded digital asset portfolio. By recognizing the distinct sectors within the crypto economy, including DeFi, NFTs, and blockchain technology, one can mitigate risks associated with concentration and enhance long-term performance.

With emerging projects, adaptive strategies, and thorough vetting, investors can position their portfolios to exploit diverse growth avenues and participate in a fluid market characterized by volatility and opportunity.

Key Takeaways

- The cryptocurrency market is evolving, making a case for viewing altcoins as a legitimate asset class rather than mere alternatives to Bitcoin.

- Projects like Lunex, Aave, and Aptos are leading the charge with significant market caps and growth potential, indicating a shift in investor focus.

- To capitalize on this shift, investors should adopt diversified investment strategies tailored to the unique characteristics and risks of various crypto sectors.