Introduction

In the intricate world of finance, dividend policy stands as a critical determinant of shareholder satisfaction and company valuation. This cover story examines the robust dividend payout policies through a comprehensive analysis using dynamic panel regression, focusing especially on factors like speed of adjustment and half-life in diverse economic contexts.

Understanding Dividend Policies

Dividend policies vary markedly across different economies and market sectors. Research indicates that firm size, investment opportunities, and ownership structure significantly influence how dividends are determined, especially in emerging markets. Recent studies in the Gulf Cooperation Council and Southeast Asia suggest a complex interplay between internal corporate factors and external market conditions affecting dividend decisions.

Literature Gap

Despite extensive research on dividend measures, gaps remain, particularly regarding operational efficiency factors and the impacts of macroeconomic conditions on dividend policies. Existing studies often concentrate on developed markets, leaving a substantial void in understanding dividend dynamics in developing nations.

Methodological Advancements in Dividend Research

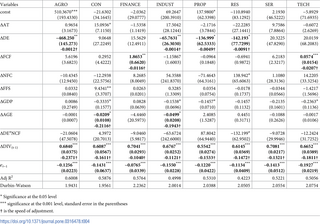

This study asserts its contribution by leveraging advanced statistical methods such as ARIMA and WLS, enhancing the reliability of the findings. By using these methodologies, the research aims to uncover how certain factors—like asset turnover and company age—impact dividend policies in a comprehensive manner.

The Critical Role of Speed of Adjustment and Half-Life

The speed of adjustment reflects how quickly a dividend policy reverts to its established norm following economic shocks, while half-life quantifies the duration it takes for half the deviation from equilibrium to be corrected. Understanding these concepts is essential for stakeholders looking to predict dividend behavior amid market fluctuations.

Sector-Specific Insights

Different sectors exhibit unique dividend behaviors based on asset efficiency and firm growth dynamics. For instance, in capital-intensive industries, firms may prioritize reinvestment over dividend distribution, countering trends in sectors where stable cash flow encourages higher payouts. Consequently, tailored approaches to understanding dividend policy across sectors are vital for investors.

Key Takeaways

- Dividend policies are shaped by a myriad of factors including firm size, profitability, and economic conditions.

- There are significant gaps in existing research, particularly regarding developing markets and operational efficiencies.

- Advanced statistical techniques enhance the understanding of dividend dynamics beyond traditional methodological approaches.

- Sector-specific differences highlight the necessity for a tailored understanding of dividend policies in various economic contexts.