Equities at Record Highs: Navigating Employment Trends and Economic Cautions

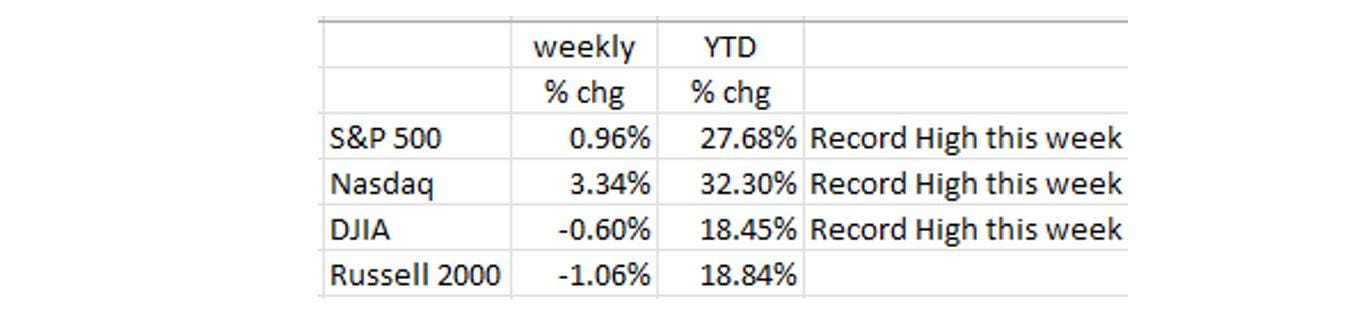

Financial markets have been on a rollercoaster ride, with investors eagerly awaiting the latest jobs data. The results? They didn’t disappoint! Much like the Goldilocks tale, the jobs numbers were neither too hot nor too cold—they were just right! This positive outlook propelled the S&P 500 and the Nasdaq to close at record highs last Friday, signaling a robust confidence in the market.

However, as we celebrate these milestones, it’s crucial to keep an eye on the broader economic landscape. Employment trends, retail sales expectations, and rising delinquencies paint a more complex picture that warrants caution. While the job market shows signs of resilience, other indicators suggest we should not get too carried away. Let’s dive deeper into these factors that could influence market stability.

Understanding Employment Trends

The latest data shows that employment levels are improving, but there are underlying trends that demand attention. A closer look at job creation reveals that while there are gains in certain sectors, others are lagging. For instance, the tech industry continues to thrive, but manufacturing and service sectors are facing challenges. This disparity can lead to uneven economic growth, affecting consumer confidence and spending.

Retail Sales Expectations

Moving on to retail sales, expectations are mixed. On one hand, consumer spending has shown resilience, driven by rising wages and a strong job market. On the other hand, inflation and supply chain issues pose significant risks. As we approach the holiday season, retailers are hopeful for a surge in sales, but caution is warranted. Will consumers spend freely, or will they hold back due to economic uncertainties? This question remains unanswered.

The Concern of Rising Delinquencies

Another layer of complexity comes from rising delinquencies. As borrowing becomes more accessible, many consumers are taking on debt, leading to an uptick in late payments. This trend could signal trouble ahead, as increased delinquencies can impact credit scores and overall financial health. If consumers start to default on their loans, the ripple effect could reach far and wide, affecting everything from lending practices to consumer spending.

Finding Balance in Investment Strategies

Given these contrasting indicators, investors must strike a balance in their strategies. While the equity markets are riding high, the mixed signals from employment trends, retail sales, and delinquencies suggest a more cautious approach may be prudent. Diversifying portfolios and staying informed on economic developments will be essential in navigating these unpredictable waters.

Conclusion: Stay Informed and Cautious

In summary, while the recent jobs data has boosted market confidence, it’s vital to remain vigilant. The economic landscape is nuanced, with employment trends, retail sales expectations, and the potential for rising delinquencies all playing critical roles in shaping the future. As we celebrate record highs in the markets, let’s keep an eye on these underlying factors to ensure we’re not caught off guard.