Introduction

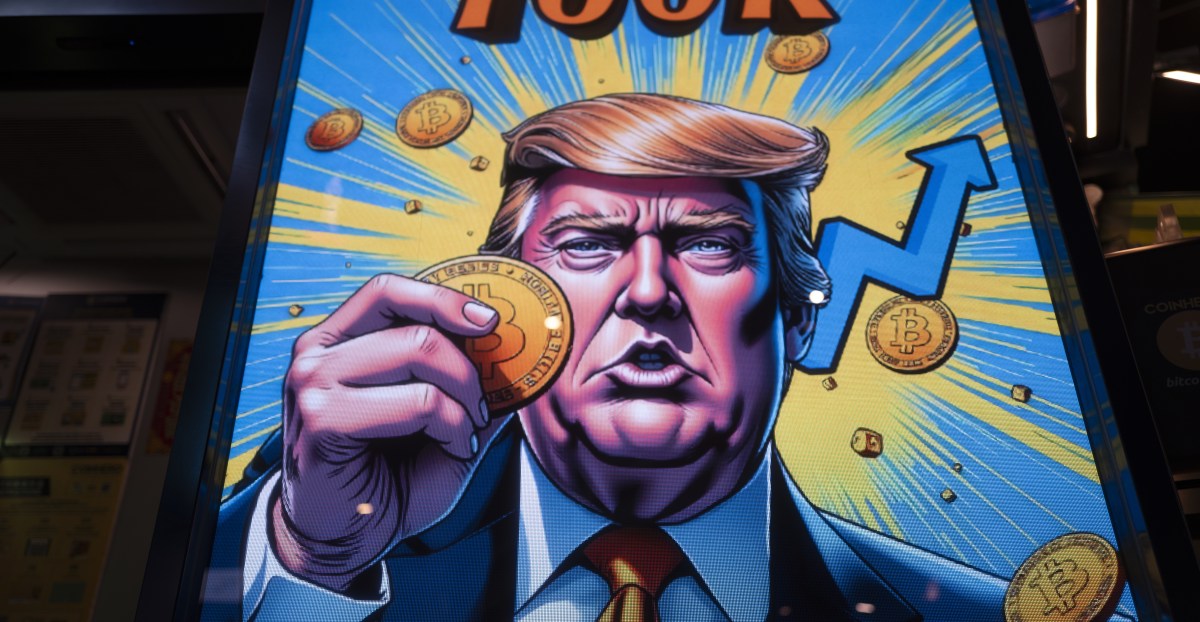

The price of Bitcoin has recently surpassed $100,000 for the first time, a reflection of renewed confidence in the cryptocurrency market amid political changes in the United States. With the promised pro-crypto policies from the incoming Trump administration, investors are optimistic about the potential for favorable regulatory conditions.

The Surge of Bitcoin

On Election Day, Bitcoin was valued at $69,374, but within a month, it skyrocketed by over 44%. This price surge was not limited to Bitcoin; other cryptocurrencies, including Ethereum and XRP, also experienced significant gains. Analysts attribute this rise to investor optimism and expectations of a relaxed regulatory environment under Trump’s administration.

Market Legitimacy and Regulatory Landscape

Bitcoin’s acceptance as a legitimate asset has significantly changed over recent years. While once viewed as a fringe financial product, Bitcoin is now being integrated into mainstream investment portfolios. This shift has been bolstered further by the Trump administration’s anticipated regulatory shifts, which promise to ease restrictions that have hampered the crypto industry in recent years.

Key Political Appointments

Key nominations, such as Paul Atkins for the SEC and some rumored appointees from crypto-friendly organizations, signal a potential shift toward deregulation and encouragement of innovation in the crypto space. This political landscape suggests that the regulatory grasp that has tightened around cryptocurrencies may soon loosen, giving way to broader participation and investment.

Investment Vehicles and ETFs

The introduction of cryptocurrency exchange-traded funds (ETFs) has expanded access to Bitcoin for average investors. These funds allow people to invest in Bitcoin without directly purchasing and holding it, thereby insulating them from some risks associated with traditional cryptocurrency trading. Major financial firms like BlackRock and Fidelity have begun to launch Bitcoin funds, marking a significant milestone in the market’s evolution.

Long-term Outlook

Despite the rampant enthusiasm surrounding Bitcoin, experts caution that the cryptocurrency market remains volatile. Economic fundamentals and potential over-speculation could lead to corrections. Ramaa Vasudevan, an economics professor, notes that while the enthusiasm might indicate a promising future, the risks of another market bubble are ever-present.

Key Takeaways

- Bitcoin’s price has surged past $100,000, driven by optimism about regulatory changes under the Trump administration.

- The political landscape is shifting towards a pro-crypto stance, which could lead to deregulation.

- Investment options like Bitcoin ETFs are allowing broader access to cryptocurrency markets.

- While the outlook is bullish, concerns remain regarding market volatility and potential bubbles.