Introduction

In a striking shift within the cryptocurrency landscape, XRP has eclipsed Bitcoin as the most-traded digital asset on Coinbase, signaling a notable rise in U.S. investor interest. This development reflects broader market trends and the increasing allure of XRP following significant political and regulatory events.

The Rise of XRP

As the third-largest cryptocurrency by market value, XRP has recently overtaken Bitcoin on the Nasdaq-listed exchange, Coinbase. This change highlights a return of demand for XRP, particularly among U.S. investors, who previously had limited access to opportunities compared to their global counterparts. While Bitcoin remains dominant on Binance, the largest exchange by trading volume—excluding U.S. investors—XRP’s momentum indicates a critical shift in market preferences and sentiments.

Factors Fueling Interest

The surge in XRP’s trading volume is linked to several pivotal events, including a notable meeting between Ripple CEO Brad Garlinghouse and President-elect Donald Trump. Speculation surrounding the potential approval of a spot XRP exchange-traded fund (ETF) in the U.S. has also amplified investor enthusiasm. Furthermore, XRP has re-emerged as a favorite among investors, especially after a price rally that has seen the cryptocurrency rise over 600% since November, peaking at $3.33—the highest it has been since 2017.

Market Dynamics

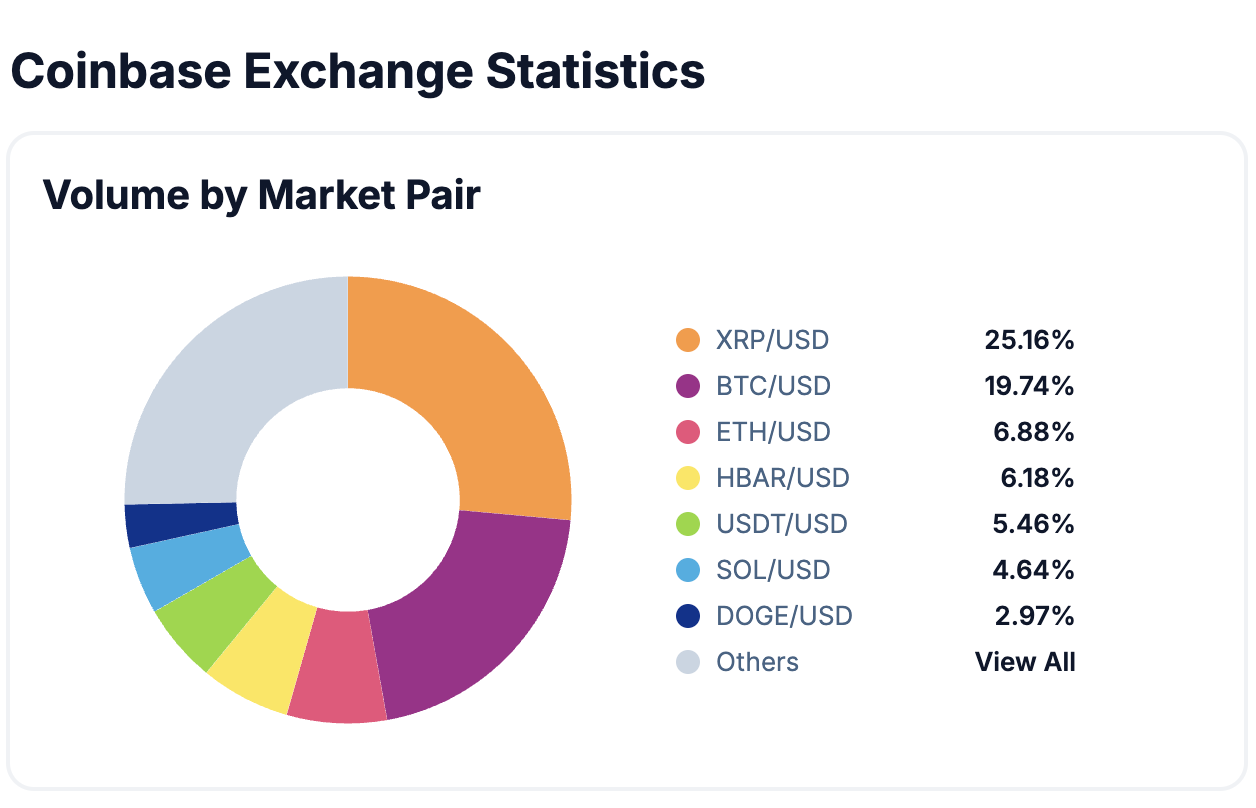

Currently, the XRP/USD trading pair accounts for a significant 25% of Coinbase’s total trading volume of $6.86 billion over a 24-hour period, overtaking the BTC/USD pair, which holds 20%. The dynamics indicate a growing preference among U.S. investors for XRP, especially as retail and institutional trading resume post-election.

Key Takeaways

- XRP has become the most-traded cryptocurrency on Coinbase, surpassing Bitcoin.

- The rise in XRP’s popularity is tied to key political events and the potential for ETF approval.

- The cryptocurrency’s price has increased significantly, reflecting renewed investor confidence.